It’s good to be a business owner in the Aloha State. Not only do they live in a notoriously beautiful place, Hawaiian companies have the highest credit scores of any U.S. state, averaging a business credit score of 54.6 on the Experian Intelliscore Plus℠ scale of 0 to 100.

Hawaii’s credit score is considered low- to medium-risk. Businesses with scores in this range typically find it easier to qualify for loans with the best terms and lower interest rates.

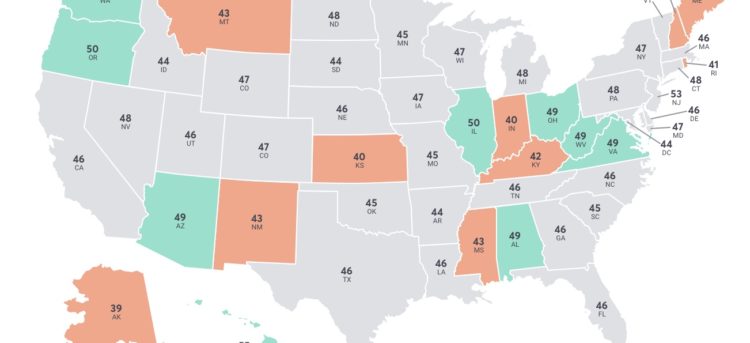

According to Nav’s 2018 Business Credit Snapshot by State, Washington placed second, right behind Hawaii with an average score of 52.6, followed by Illinois, Oregon and West Virginia.

Nav ranked each state in the U.S. by taking the business credit scores of 15,478 of its small business customers and then calculating the average credit score for each state.

Unlike personal credit score models which typically range from 300 to 850, most business scoring models range from 0 to 100. Intelliscore Plus℠ is just one scoring model lenders can use to evaluate creditworthiness of businesses. Others include the FICO® SBSS℠ score and the D&B PAYDEX score.

The Bottom of the Pack

Alaska ranked last on this year’s list, with an average business score of 38.7, considered “medium” risk on the Intelliscore Plus scale. Kansas was positioned in second-to-last place, with an average score of 39.6, followed by Indiana, Maine and Rhode Island.

Businesses with a score in this range may find it more difficult to qualify for traditional business financing, like bank loans — and may turn to alternative or online business loans.

“Business owners I’ve talked with are often surprised to learn that both business and personal credit scores may impact whether or not they will get small business financing, and how much they will pay,” says Gerri Detweiler, education director for Nav. “Their next question is usually, ‘How do I get my business credit scores?’”

Ranking the Top 10 States

This is the second year that Nav has ranked the business credit health of each state. 2017’s list can be found here. The top 10 states (with their corresponding average credit scores) are as follows:

1. Hawaii (54.6)

2. Washington (52.6)

3. Illinois (50)

4. Oregon (49.7)

5. West Virginia (49.4)

6. Arizona (49.1)

7. Alabama (48.9)

8. Ohio (48.6)

9. Virginia (48.5)

10. Michigan (48.32)

Few Repeats From Last Year’s List

Oregon, Alabama and Michigan were the only states to repeat from last year’s top ten list. Because business credit scores have such a narrow range (from 0 to 100), a small uptick or downtick can mean a big difference in rank.

For example, Alaska had the eighth-best business credit score on Nav’s 2017 list, but ranked last this year.

Other notable movers were New England states New Hampshire and Maine, who both ranked near the top of the list in 2017, but fell near the bottom of the pack this year, ranking 46th and 48th respectively.

It’s also important to note that the narrow business credit score range means that while those at the bottom are lower, there’s not a huge difference between being considered “medium” risk or low-to-medium risk. Only 16 points separated top-placed Hawaii from last-placed Alaska.

Little Correlation with Consumer Credit

While both personal and business credit scores can impact a business owner’s ability to secure financing, there’s little correlation between states with the highest average business credit and consumer credit scores.

Hawaii is the only state that placed in the top ten of both consumer and business credit scores. Alabama and West Virginia are among the states with lowest consumer scores, but made the top ten of business credit scores.

Consumer credit data was sourced from Experian’s 2017 State of Credit report. A list of business credit score rankings for every state, trends and methodology for Nav’s 2018 State Business Credit Snapshot are available here.

This article was originally written on March 30, 2018 and updated on January 8, 2019.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.