This is the second post about Nav’s loan calculators. Previously, we talked about the math behind our merchant cash advance APR calculator where the APR can only be approximated before the actual payments since the contract is card revenue-based. In this post, we will be talking about the math behind the business term loan calculator where the APR is deterministic and pretty much works like a mortgage.

The APR for a business term loan is very straight forward to figure out. In fact, if there’s no origination, application and monthly servicing charges, the APR will be the SAME as the interest rate the lender quoted. APR, by definition, is the effective interest rate a lender charges. If a lender doesn’t charge any extra fees, then the effective interest rate (APR) will be the same as the quoted interest rate. But most business lenders charge an origination fee, making the APR higher than the quoted interest rate.

We use monthly compounding for our term loan calculator as most business term loans asked for monthly payments. Here are exactly how Nav’s term loan calculator calculate APR:

- Calculate monthly payment using the Excel formula: Monthly Payment =PMT((Interest Rate/12), Loan Term, Loan Amount)

- It’s not super common, but some lenders will charge an extra servicing fee in addition to the monthly payment calculated from one. Therefore, your Actual Monthly Payment is equal to (Monthly Payment + Monthly Servicing Charge).

- Your actual proceeds will be different from the loan amount if there’s origination & application fee. Your Actual Proceeds is equal to (Loan Amount) – (Origination + Application Fees).

- Now. We can calculate the Monthly Rate using the Excel formula: Monthly Rate = RATE(Loan Term, Actual Monthly Payment, -(Actual Proceeds))

- APR = (Monthly Rate) * 12

Merchant Cash Advance vs. Credit Card Cash Advance

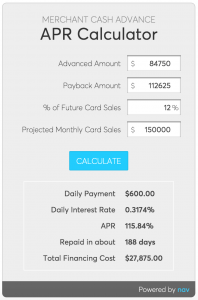

The following are the parameters from an MCA term sheet:

- $85,000 paid to the merchant

- $112,625 of the future card receivables will be paid to the purchaser (the MCA provider)

- 12% of the debit/credit card payments will be paid through ACH to the purchaser (until $112,625 is fully paid)

- $250 administrative cost paid by the merchant.

- $150,000 monthly card sales

Because of the $250 administrative cost, the actual amount deposited to his bank account is ($85,000 – $250) = $84,750. The cost of the merchant cash advance is therefore ($112,625 – $84,750) = $27,875 or 32.89% of the advance amount.

Bottom line: APR = 115.84% , Total Cost = 32.89% of the advanced amount , Paid back in about 6 months.

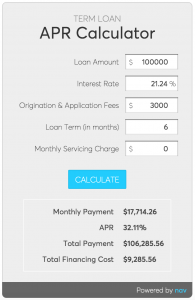

Now, if instead we get a credit card cash advance of $100,000 with 3% origination fee ($3,000) and 21.24% interest rate, 0% monthly servicing charge as described by the term sheet here and we will also pay back in 6 months. As shown below, the total cost is $9285.56 or ($9285.56/($100,000-$3000)) = 9.57% of the advance amount.

Bottom line: APR = 32.11% , Total Cost = 9.57% of the advanced amount , Paid back in about 6 months.

Although the two advances have different compounding methods when calculating APR, you can obviously see the credit card cash advance is a much better deal as you are paying 1/3 of the financing cost with the similar repayment period. If you have a choice between the two, there’s no reason to pick the more expensive option. These two products have almost no common parameters (except for the advanced amount) but using Nav’s loan calculators, you can compare them on an Apple-to-Apple basis— and that was exactly the motivation for creating these calculators.

We will be talking about the math behind Daily ACH Debit Calculator (aka OnDeck APR Calculator) next week and we will introduce more examples. Stay tuned.

This article was originally written on December 15, 2014 and updated on July 2, 2020.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.