PAYDEX is a business credit score that’s generated by Dun & Bradstreet (D&B). Their model analyzes a business’ payment performance (i.e., if it pays its bills on time) and gives it a numerical score from 1 to 100, with 100 signifying a perfect payment history.

A business’ PAYDEX score is used much like an individual’s FICO score. It helps lenders, vendors and suppliers determine whether to approve you for financing and on what terms.

Typically, the better the score, the more generous the terms extended. This can save your business money and give you more time to pay for supplies or services, leveling out cash flow.

How is my PAYDEX score calculated?

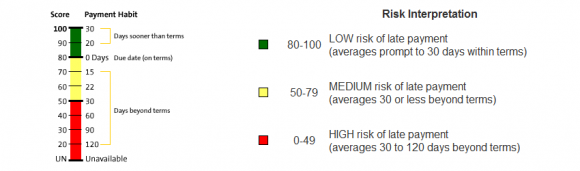

To determine your business’ PAYDEX score, Dun & Bradstreet gathers data from the suppliers and vendors with which you do business over a rolling 12-month period. Each supplier/vendor is considered a single “payment experience.” Dun & Bradstreet analyzes the promptness of your payments against the terms of sale for each payment experience. So, the faster you pay your bills, the better your score.

PAYDEX scoring is dollar-weighted, which means that each payment experience is weighted in terms of the number of transactions and the overall dollar value of those transactions. That means your transactions with your IT vendor, with whom you spend thousands of dollars monthly, comprise a greater percentage of your PAYDEX score than your transactions with the carpet cleaner who comes out to steam your rugs annually for a few hundred dollars, for example.

What is my PAYDEX score used for?

PAYDEX is primarily used by vendors and suppliers to judge your business when determining what terms to extend on trade credit (e.g., net 30, net 60, etc.) This is important because having more time to pay your bills can help you better manage cash flow.

Lenders and creditors can also consider your PAYDEX score before extending lines of credit or loans to your business. You should aim to maintain a PAYDEX score of 75 or higher to ensure qualification for these types of financing.

Copyright: D&B

How can I improve my PAYDEX score?

Since your PAYDEX score is based entirely on the promptness of your payments to vendors and suppliers, the only way to improve it is to make sure you are paying on time. It is important to note, however, that paying on time will only earn you a score of 80. For a perfect PAYDEX score of 100, you need to pay early.

You should also make sure you open at least four open trade accounts. That’s the minimum amount D&B requires to generate a score. Having no PAYDEX score is just as bad as having a low one.

Nav lets you check your PAYDEX score online for free. You’ll also get tips and insights to make your score stronger, so you can negotiate better vendor terms, save money and more easily manage cash flow.

This article was originally written on April 8, 2015 and updated on November 3, 2016.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.