Previously, we reviewed FundingCircle‘s business term loans. It was a pretty reasonable product with decent rates and a streamlined online application. It has been a while and we decided to revisit the application and see what has changed since July 2014.

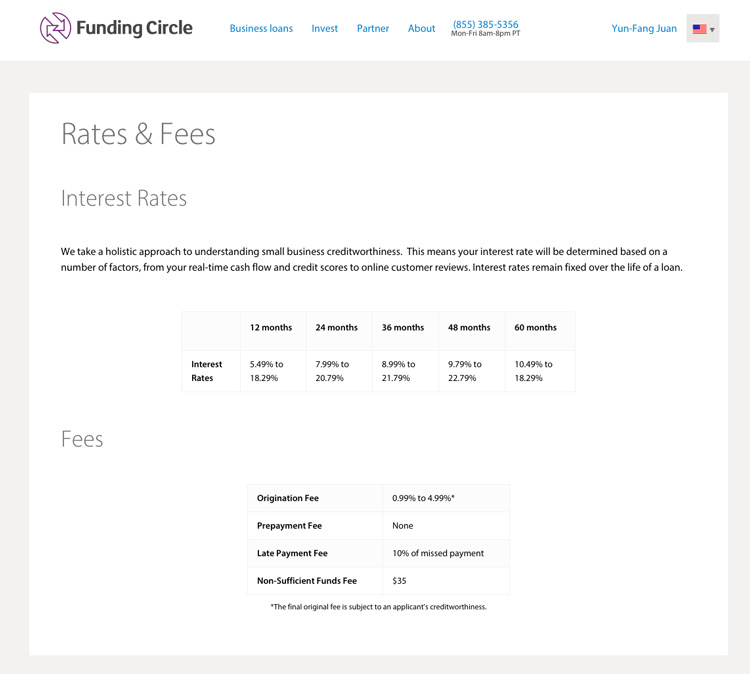

Rates & Fees

FundingCircle has changed their pricing quite a bit since last year. The rate was between 9.99% and 20.99% last year. The new range is now 5.49% – 22.79% and they added 1-year and 2-year terms to businesses who need shorter term capital. They also changed the origination fee from 2.99% to 0.99% – 5.99% based on borrowers’ risk.

We spoke to FundingCircle about these changes. They told us that these new rates and fees reflected two major changes on their underwriting:

- The overall interest rates/origination fees are lower for borrowers with the same risk profile. 98% of the borrowers would get a better APR than the APR they would have had last year given that the risk profile of the borrower remains constant. This is due to the improved underwriting after seeing the performance of the loans they have issued in the past few years.

- They are extending credit to certain businesses who were previously turned down. That is also part of the reason why their highest interest rate is higher the before. The hard requirements don’t not change but they are more confident in assessing risks and can now underwrite loans who are more risky with a slightly higher pricing. If things go well, they might expand their credit box further.

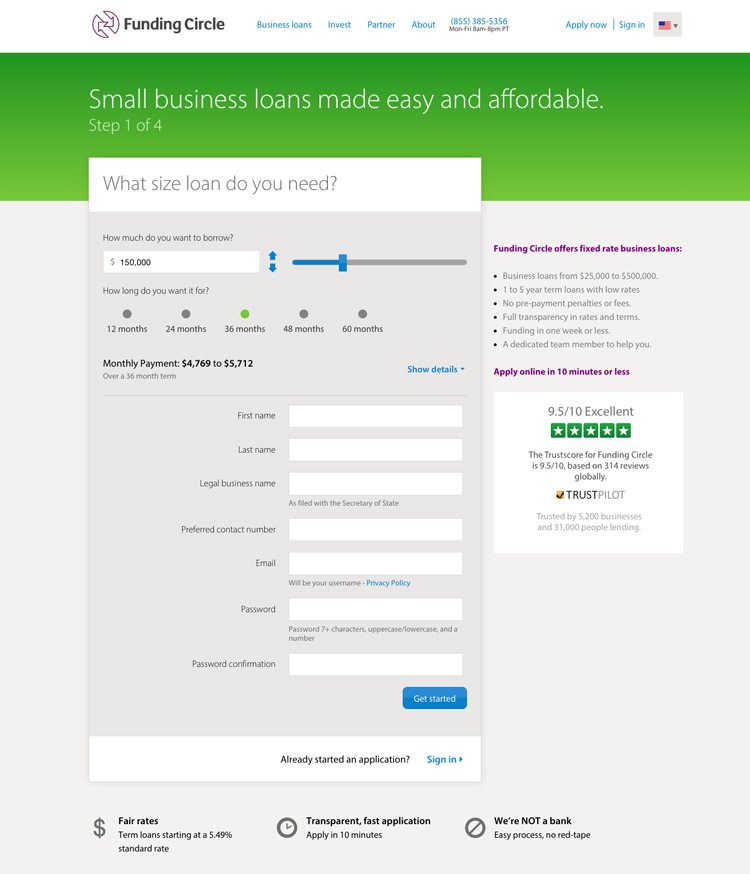

The Application

Now, let’s go through their application again. I am applying for a smaller loan this time: $51,000 to remodel my (fictional) hair salon.

First, I created an account and specified I would like a $51K loan with 2-year term.

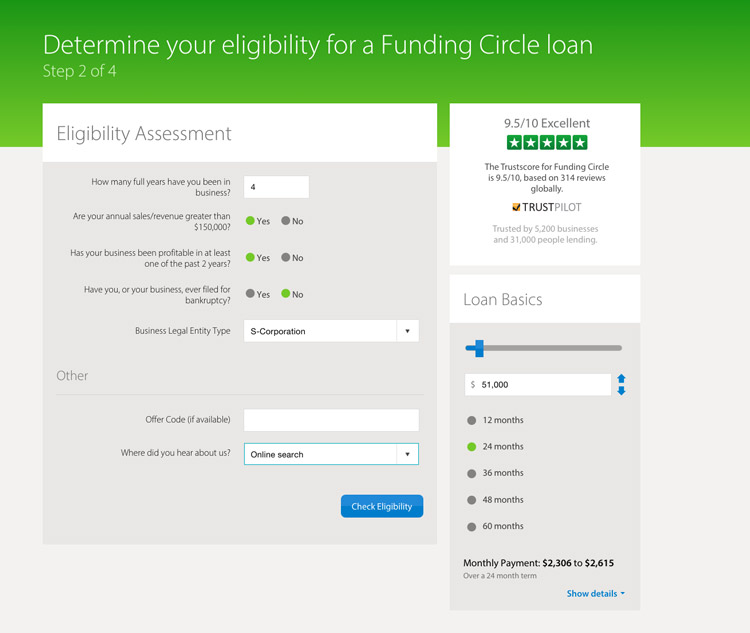

Next, it’s an eligibility test. Fundastic Hair is an S-corp with over $150K annual revenue and 2+ years in business, and I have never ever filed any bankruptcy before.

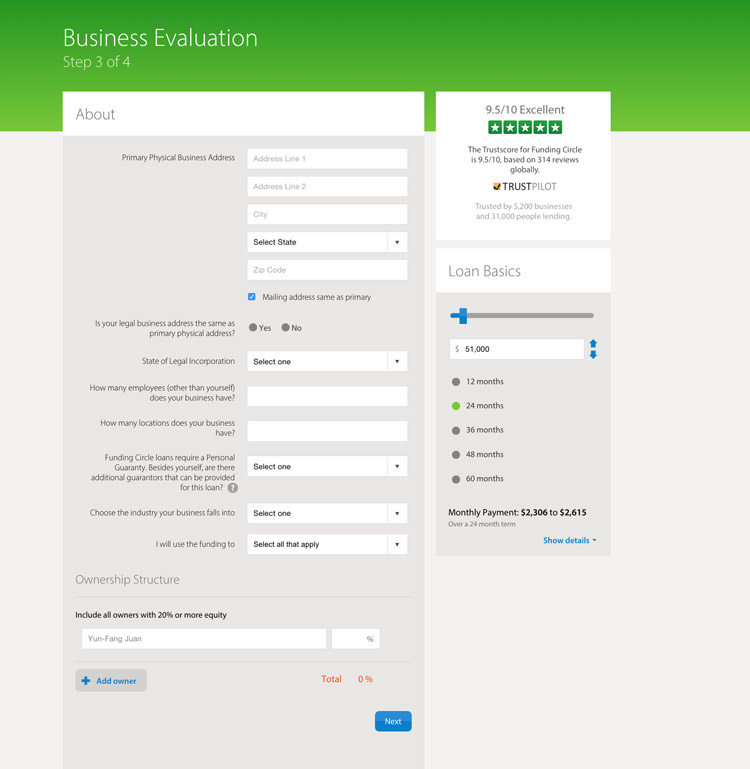

Next, I filled out my business information, loan purpose and agreed that I will personally guarantee the loan.

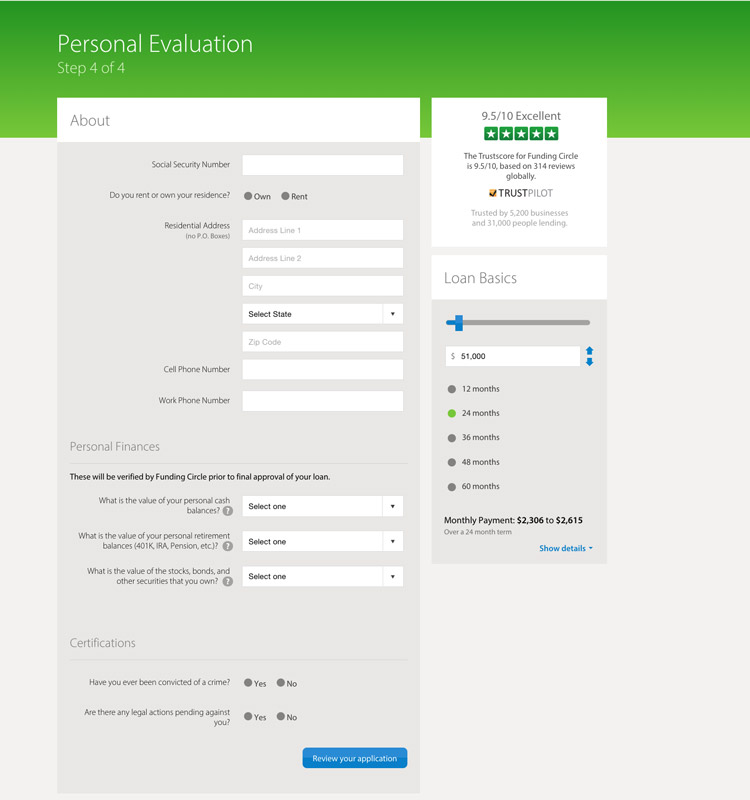

Then, some personal information including SSN and financial information.

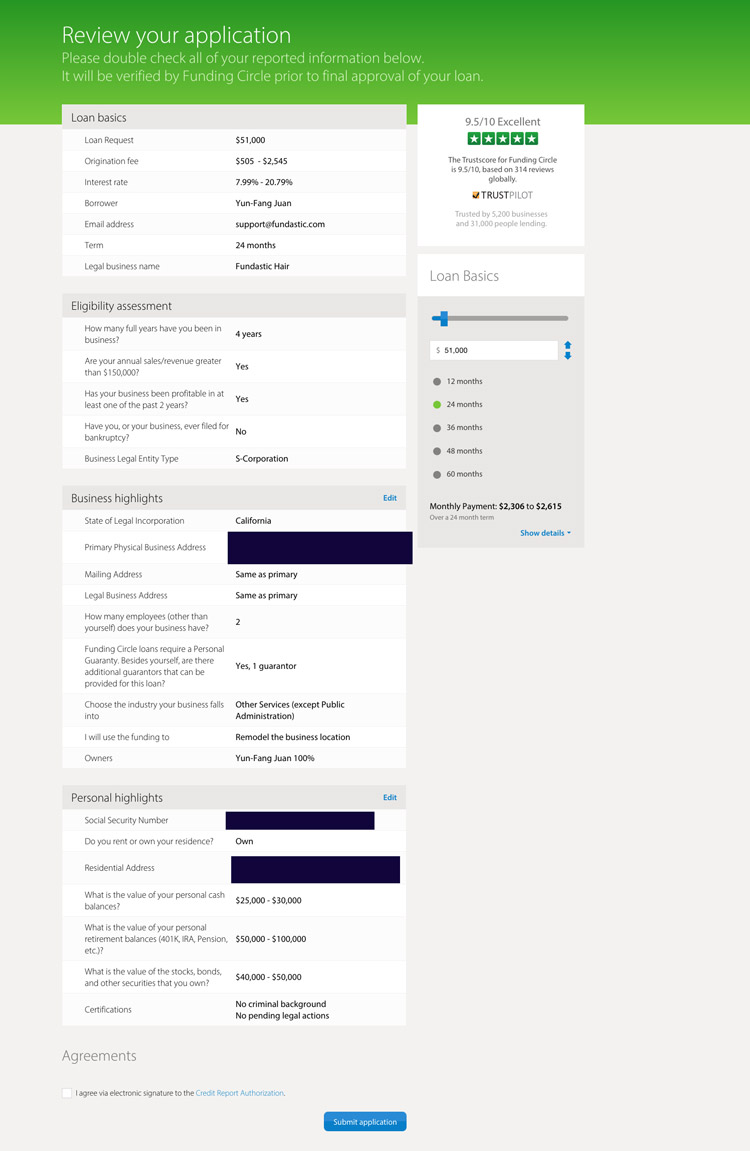

Reviewed the information I entered, agreed to a credit check (hard inquiry) and clicked “Submit”.

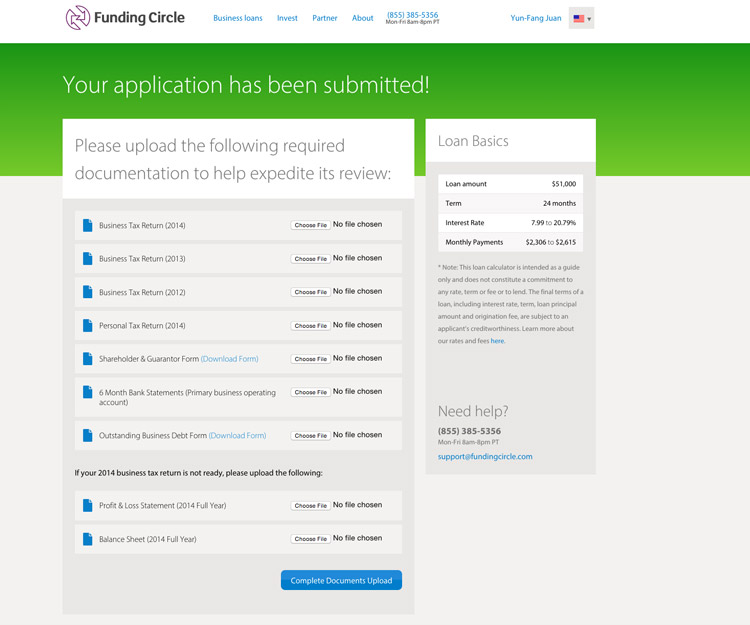

Lastly, I had to upload tax returns, bank statements, business debt summary and a signed guarantor form.

Boom! That’s all. Compared to a year ago, there’s a dramatic simplification of FundingCircle’s online application. They didn’t ask me to write an essay about my business or the purpose of funding. Nor do they ask you for a P&L statement or balance sheet. They still do not give you instant pricing but they make the application a lot simpler, which can certainly save you a lot of time, especially if you are a typical small business who do not have all the financial reports up to date all the time.

Conclusions

Overall, there’s a strong improvement of FundingCircle’s loan product. They offer better rates, added 1-year and 2-year products, expanded their credit box and simplified their online application. They also offer larger loans up to $500K. Most other alternative lenders’ upper limit is a lot lower than that. If you are in need of a big business loan and were turned down by a bank, FundingCircle is one of the top options. You can read more about them here.

This article was originally written on June 25, 2015 and updated on November 3, 2016.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.