As consumers, we tend to think of financing in the terms of an auto loan or home mortgage—single-digit rates, all conveyed to the consumer in the same format: Annual Percentage Rate (APR), or the total cost of the loan to the borrower.

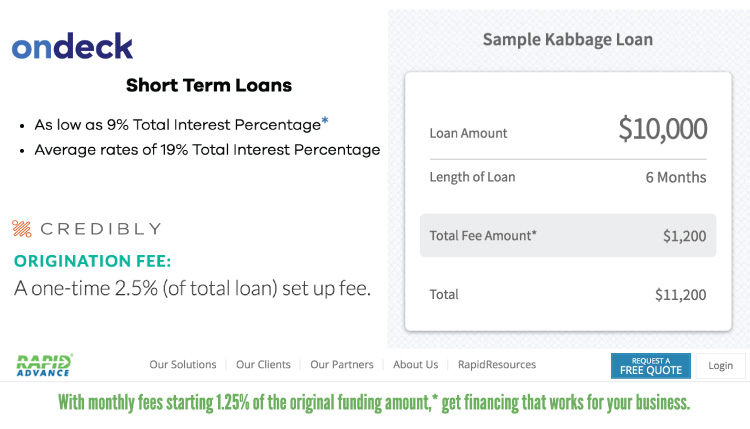

In the world of small business, on the other hand, there is no standard way to display loan rates, meaning a lender can convey a rate in any number of different ways and doesn’t necessarily have to disclose the total cost in the displayed rate. “Interest rates,” “monthly payment amount,” “payback amount,” and “total interest percentage” are just a few of the terms that can be used to describe the cost of a loan. It’s not always going to be the loan with the cheapest “rate” or lowest monthly payments that has the lowest total cost because of various fees that lenders add to a loan that could skew the annual percentage rate higher.

How to Evaluate Your APR

You shouldn’t need a PhD in math to determine the total cost of your loan, but it sometimes seems like loan providers are intentionally making it hard.

When analyzing your loan options, be sure to look for various associated fees, including:

- Origination fees (most common)

- Administration fees

- Application fees

- Monthly maintenance fees

- Underwriting fees

- Closing costs

And more. These fees can really add up over the term of your loan, significantly impacting its total cost.

Additionally, you’ll need to make sure you understand any added cost if something changes with your loan. Let’s say you want to make early payments or prepay the entire loan back early. With consumer loans, making early payments often means saving thousands of dollars in the long term because you’re cutting down the amount of interest you owe to the lender. But some online small business lenders charge a hefty prepayment penalty for paying back your loan early—in some cases, you may still be responsible for the total cost of your loan.

One financing option that is often overlooked is business credit cards. It’s always a good idea to have one or two business credit cards available for short-term emergencies and working capital, and what you might not realize about credit cards is that they actually feature relatively low APRs in comparison to other business financing options. Typical APRs on a business credit card range from about 13% – 25%—keep that in mind when considering options for emergency capital or how to finance your next large purchase.

Along these lines, Nav has two hard-and-fast pieces of advice:

1. Talk to an unbiased lending specialist about your loan options and any fees associated with the loan. Avoid talking to loan brokers who may try to sell you on a higher cost product because they get a larger commission for closing it. (In other words, they don’t always have your best interest in mind.)

Nav offers a team of credit and lending specialists who help borrowers find the best loans as well as build their business credit so they can secure even lower-cost funds in the future. We only generate revenue if you get the best financing option suited to your needs, so our team is unbiased and has your best interest in mind.

2. Use an APR calculator to verify the cost of the loan yourself before you sign on the dotted line. Nav has created a series of APR calculators to help with this exact need. Check them out here, or type in your terms below to calculate your true cost.

This article was originally written on August 29, 2016 and updated on November 1, 2016.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.