Advertiser & Editorial Disclosure

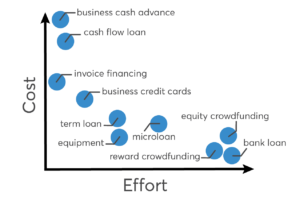

When it comes to financing your business, there’s an unfortunate tradeoff.

Small business owners who need financing in a matter of days will likely pay a high price for the convenience of little paperwork and fast turnaround. There are generally less requirements to qualify, and the speedy underwriting is accomplished by taking less time to evaluate how risky of an investment you are. The less they know about your business, the more they will charge.

Related: How to Get a Small Business Loan

Evaluating the risk level of a business takes time and energy, often on the part of both the business and the lender. But as is true in many of life’s situations, mor e effort means more reward, and that reward comes in the form of lower annual percentage rates (APRs).

e effort means more reward, and that reward comes in the form of lower annual percentage rates (APRs).

This graph illustrates the cost/effort tradeoff amongst common business financing options. Here’s how long those low-cost, high-effort loans take to get, and how you can speed up the process to land the right financing for your business.

Bank Loans

How long it takes: 2+ months

Cost: 5 – 10% APR

Banks offer some of the lowest interest rates you can find on small business loans, but they take longer to get than most other loans. They also have stricter requirements, and often prefer making larger loans to more established businesses.

Some banks do have faster options. U.S. Bank, for example, has a Quick Loan option you can get as soon as the next business day. Equipment loans tend to have less paperwork and faster turnaround. Equipment loans are secured by the equipment you are purchasing, so the collateral requirement is already taken care of. Talk to your bank about these options.

SBA Loans

How long it takes: 1+ month

Cost: 6 – 13% APR

Loans backed by the Small Business Administration are some of the least expensive options out there. The 7(a), 504 and microloan programs are the SBA’s most popular programs. SBA loans are guaranteed by the Small Business Administration, but provided to small business owners through banks and financial institutions (here’s a list of the top 10 SBA lenders.)

The SBA does also offer an express loan. SBA Express loan applications get a response within 36 hours, a process which usually takes about one month through a regular 7(a) loan. Interest rates for Express loans can be up to 3.25 percentage points higher than 7(a) loans, and follow generally the same standards and uses as the 7(a) loan program.

SBA Loan by SmartBiz

Reward Crowdfunding

How long it takes: 1+ months

Cost: Up to 10% of money collected plus reward

If you can tell a compelling story about your business or product, reward crowdfunding should be on your list of possible options. The premise is simple: You offer potential fans (via a website like Kickstarter or Indiegogo) a reward or the promise of future product in exchange for money now. This is a great way to gain proof of concept and raise money to develop your budding business.

The reason crowdfunding takes so long is that you can’t skimp on the material you create to market your business to potential customers. Depending on your company, you might need professional photos or a video, a killer description that catches a reader’s eye, and the right rewards to make it worth the customer’s time and money.

Equity Financing

How long it takes: 3+ months

Cost: Ownership of your company

Similar to reward crowdfunding, equity crowdfunding and financing involves pitching your business to potential investors. The material you create to present your business may be different, however — for example, you might find that a presentation is more appropriate than a video.

In addition to what you create to pitch your business, you’ll need a comprehensive business plan, executive summary and detailed financial projections.

Once you have all necessary material, pitching and finding the right investors takes time and effort. In some cases, it can take years. You also might need a corporate legal team to review any term sheets with you — an extra cost you may not see coming.

How to Speed Up the Process

Let’s face it. Most of us aren’t the best at planning ahead, especially when you’ve got a dozen other things on your plate. But most businesses need a cash infusion at some point to support either regular bills or growth opportunities, and there are a few things you can do now to speed up the loan application process later on by having documents at the ready.

- Put together a business plan. Many lenders want to see projections of how your business will grow in the future, especially if you’re seeking a longer-term loan. (Learn more about how to write a business plan here.)

- Track revenues and expenses in a formalized P&L statement. In addition to future projections, lenders want to see past performance. Your Profit and Loss statement is one way they could ask you to illustrate this. Your P&L statement shows your total sales minus cost of goods sold (COGS) and other expenses (advertising, shipping, salaries, etc.) to arrive at your total profit.

- Bolster your business credit scores. When lenders decide to grant you a loan, they’re making an investment in both you and your business. To evaluate risk, your personal credit scores and reports will be called into question, and your business credit scores may be too. Make sure you know what your scores are, and if they’re low, know what you need to do to improve them. Don’t wait until the last minute to make changes! Building better credit takes time, and low scores can disqualify you from the best options. (Check your scores — both personal and business — for free on Nav.)

This article was originally written on May 4, 2017 and updated on May 22, 2018.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.