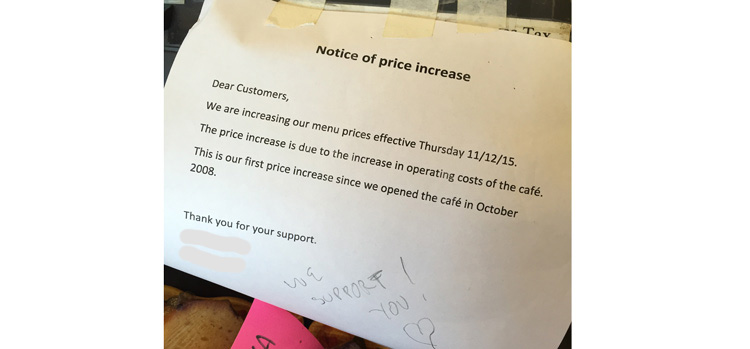

This morning I payed a visit to my favorite coffee shop and saw this sign attached to the cash register.

I love this sign for a number of reasons. The obvious reason is the fact that a customer chose to advertise their support of the price increase directly on the sign, inadvertently encourage others to support the cafe as well. The sign also reassures me that my favorite cafe is doing what they can to ensure survival in 2016.

Financial planning is an important step for every business, and it’s something that should be revisited at the end of each year to plan for the next. Do you expect your operating costs to increase within the next year? Whether your answer is yes or no, here are a few things to think about as you plan your financials for the new year.

Build business credit now

Building business credit now (or ideally last month) will help put the ball in your court for 2016. Strong business credit scores can help you secure secure better trade terms with important suppliers in your industry. More and more lenders are starting to look at your business credit score too — for example, if you’re seeking an SBA loan or bank loan, your FICO SBSS score will determine if you’re prequalified, and if you are looking at online term lenders, your D&B PAYDEX score or Experian Intelliscore Plus might be called into question as well.

In other words, a strong business credit score could be the difference between net-15 or net-60 day payments through your suppliers, or the difference between 10% APR and 50% APR on a business loan.

Even if you don’t expect the need for long repayment terms or outside financing, a strong business credit score can put you in a good light should you run into emergencies where cash is tight and you need to seek outside help.

Revisit cash flow and expected cash flow

Cash flow management is a key aspect of your financial plan, and forecasting future cash flow will help keep you afloat. 50% of business owners have experienced cash flow problems, and 20% cite recurring cash flow problems, so it’s wise to consider cash flow issues within the realm of possibilities in 2016. Here are three suggestions to prevent cash flow problems or get ahead of them before they occur:

- Revisit your break-even point. Is your revenue covering your current costs? Do you expect costs to increase in the coming year? What events might influence demand for your products or services? Will the salary you are awarding yourself as the owner enough to cover your personal expenses in 2016?

- Look back on the past year to identify trends in your business financials — how have your sales fluctuated? What months were busiest, and which months did you struggle? By identifying seasonal ups and downs before the new year, you can plan in advance when you might need extra financing to cover costs or temporary employees to cover periods of high demand.

- Identify where you can cut spending without decreasing the quality of your products/services that sell. For example, if you own a bar that’s building up boxes of a type of liquor that doesn’t sell, consider putting a halt on that order. With the built up inventory, consider creating delicious drink specials that incorporate that liquor, available only until that inventory runs out.

How can I increase demand in 2016?

Although your marketing plan is a whole other beast, your marketing budget should be called into question when you review your financial plan.

If you are spending on marketing, where are you spending money right now, and are those channels effective? If you don’t currently have a budget: where can you increase distribution without spending too much time or money?

For example, if you don’t yet have a business website, it might be worth investing in one—websites have become increasingly important over the years and 2016 will be no different. It costs less than $300 and one hour to have someone design one for you (check out Logoworks). This might come in handy if you decide you need to look for outside sources of money—lenders may look at your online presence when considering you for a loan to determine the credibility of your company.

Bottom line

If you’re like my favorite cafe and haven’t increased prices in 7 years, maybe now is the time to do so—but you won’t know until you sit down and revisit your finances. As a business owner juggling ten hats, so hard to set aside time to revisit your financial plan, but the New Year is an opportune time to do so.

This article was originally written on November 25, 2015 and updated on November 2, 2016.

Great to read. Thank you so much for your nice blog.

If you are looking to apply for a bank/SBA loan, to obtain funding from private investors, to lease a space for your business or to avoid costly mistakes when starting or expanding your business, you would benefit immensely by obtaining a professional Business Plan — https://wp.staging.nav.com/resource/how-to-write-a-business-plan/.