A hard inquiry can typically drop your credit score by 5— 8 points, but not all inquiries count the same. Understanding how hard inquiries work can help you shop for credit more confidently.

Shopping for credit can be smart. But it can also affect your credit scores. If you are someone who takes the time to monitor your credit report and scores, losing a few points can be stressful.

There are benefits to maintaining a high credit score. You’ll often get approved for credit faster and easier, and you can qualify for the best interest rates, including zero percent offers. That means you can borrow money cheaply, or even free. You may also be in a better position to negotiate a price on, say, a home or car if you have a high credit score.

To keep you from losing sleep over losing points, we’ve created this quick guide to help you understand hard inquiries and their impact on your scores. So here goes:

What is an Inquiry?

When you apply for a mortgage, auto or student loan, credit card, or any other form of credit, the lender has the legal right to check your credit. Your credit scores are used by lenders to decide how much of a risk you pose. The higher your score, the less likely you’ll have trouble paying back your debt and the easier it is for a lender to say “yes.”

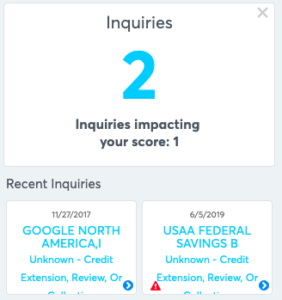

By law, credit reporting agencies must tell you every time someone checks your credit. That credit check (whether they pull a credit report, credit score, or both) is listed under the “inquiries” section of your credit report. It lists the day the credit report was accessed, and the name of the company that obtained it.

Inquiries are grouped by type, indicating whether the inquiry was for an auto loan, credit card or mortgage, for example. That identification is key to whether or not the inquiry will be a “hard” inquiry or not.

Hard Inquiries Vs. Soft Inquiries

Any inquiry that may impact your credit scores is known as a “hard” inquiry. These inquiries are shown to others who order your credit reports.

Other inquiries are only shown to you when you order your own credit reports. They are not used when credit scores are calculated. They are called “soft inquiries.” Soft inquiries include credit checks by:

- Employers

- Insurance companies

- Yourself

You know all those pre-approved offers you get in the mail? Those also result in soft inquiries.

Tip: When you review your credit reports, keep in mind the name of the company listed may be different than the name of the company where you applied. That’s because the lender may do business under another name.

So, How Many Points Are We Talking Here?

The credit impact from a hard inquiry will vary from person to person depending on their individual credit history as well as all the other information in the credit report. FICO says that one new inquiry typically results in a less than five-point drop in your credit score.

Five points isn’t a colossal amount, but it could drop you into a lower rate tier. Generate a few hard inquiries in a short period of time, and the points can add up to a more significant drop in your scores.

Rate Shopping

There are times when hard inquiries won’t drop your score as much as you think. These exceptions occur in some situations when you rate or price shop competitors for the same type of purchase. For example, if you visit several dealerships to shop for a car, each dealership will want to run your credit and they often share your application with multiple financing sources, resulting in multiple inquiries.

However, you won’t always take a hit for every one of those inquiries. Many scoring models group multiple inquiries in a short period of time and count them as one.

FICO: Auto, mortgage and student loan inquiries within a 30 to 45-day time period count as one. That time period varies, depending on which version of FICO is used. VantageScore: All inquiries (of any type) within a 14-day rolling window count as one.

To be safe, limit loan shopping to a two week period. (Note, with FICO scores, shopping for credit cards can generate multiple inquiries.)

How Long Will a Hard Inquiry Affect My Credit?

Inquiries stay on your report for two years. The Fair Credit Reporting Act requires credit bureaus to disclose to you all credit inquiries on your credit report for the past two years.

But credit scoring models typically only count inquiries that have occurred in the past twelve months. And for most consumers, inquiries won’t matter after a few months. The impact will “level off,” especially if everything else in the credit report is strong.

Pro Tip: One way to avoid too many hard inquiries is to check a lender’s approval requirements before you apply. Only apply if you’re reasonably confident you’ll be approved. That way you don’t rack up inquiries for credit when you’re likely to be denied.

Does My Credit Score Increase When Inquiries Expire?

You probably won’t see a major increase in your credit scores once inquiries drop off your credit reports. Why? Because most inquiries aren’t used in credit score calculations after twelve months. So they haven’t been impacting your credit scores.

Business Credit and Inquiries

Most business credit scores don’t take inquiries into account. But credit managers who review business credit reports may balk at extending credit or financing to some with too many recent inquiries. But as a business owner, the lender may check your personal credit when you apply for a small business loan or financing, and that may affect your personal scores, or business credit scores such as the FICO SBSS which often includes both personal and business credit data.

This article was originally written on August 29, 2019 and updated on December 10, 2019.

I recently went into contract on a home. I have been looking for 4 months. During our search we were shopping for rates. In month 1, I had three different mortgage companies run my credit, 3 hard inquiries. Before our search we got into a car lease, 1 hard inquiry, making that 4 hard inquiries in 1 month. Those 4 hard inquiries resulted to an 8 point drop in score. I started with a 791 credit score as my middle score. In month 2, we thought we found the home we wanted, but after inspection, we withdrew our offer and it was back to the market to continue our house hunt. Month 3 we found the home we wanted and went into contract. Our credit reports expired for the mortgage broker we thought we wanted to go with, so they had to run our credit again (that is 5 hard inquiries in 3 month span), which resulted to a an additional 5 point drop in score. After getting our loan estimate back we saw the closing costs as well as the rate was high, we asked the other lender (big bank) to provide us estimates and they came in with a much better rate and lower closing costs, so we went with them but they had to run our credit again since the credit report also expired from month 1. That was 6 hard inquiries in a 3 month span and to my surprise that 6th hard inquiry resulted in a 29 point drop!! That was a major surprise and actually has me worried. Should I be concerned? We close on May 31 and just found out about a credit union that can give us a rate that is 4 basis point lower than the big bank. Should I apply for this and go with the credit union?

James, I can’t give you financial advice but I’d encourage you to think about the cost of the mortgage loan over the long run at both the current rate and the other rate you’re being offered. I’d encourage you to make sure you fully understand what the credit union is offering – that seems like a big difference given how much you’ve already shopped around. Are you comparing apples to apples? And if you go with the credit union make sure you know what the minimum cut off score is for that rate. If your scores drop further from more rate shopping you may not qualify. Hope this works out for you!

I looked at an auto loan. The company said they would only run my credit one time. They ran it 5 times. How much we will this affect my scores?

Generally, auto loan inquiries in a short period of time are grouped together and counted as one. You should see a minimal impact from these (around 3-7 points). If believe those additional inquiries were unauthorized, you can dispute them though it may not be worth the effort. If you decide you want to try, this article should help: How to Remove Hard Inquiries From Credit Reports