The SBA has released the new PPP Loan Forgiveness Application Form 3508EZ, which is designed to streamline PPP forgiveness for certain businesses who qualify.

While applying for forgiveness may still seem daunting—- even with this simper form— the EZ form requires fewer calculations and less documentation for eligible borrowers.

Here we’ll walk through it together and answer some frequently asked questions.

Please note

The material contained in this article is for informational purposes only, is general in nature, and should not be relied upon or construed as a legal opinion or legal advice. Please keep in mind this information is changing rapidly and is based on our current understanding of the programs. It can and likely will change. Although we will be monitoring and updating this as new information becomes available, please do not rely solely on this for your financial decisions. We encourage you to consult with your lawyers, CPAs and Financial Advisors.

Who Can Use This Form?

The PPP forgiveness EZ form is designed for businesses that meet at least one of the following criteria:

- Are self-employed and have no employees; OR

- Did not reduce the salaries or wages of their employees by more than 25%, and did not reduce the number or hours of their employees; OR

- Experienced reductions in business activity as a result of health directives related to COVID-19, and did not reduce the salaries or wages of their employees by more than 25%.

The instructions for form 3508EZ elaborate on these points. You must qualify under one of the following three categories. If you do, then you may use this simplified form to apply for forgiveness with your lender. If you do not, then you must use the standard forgiveness form.

Again you must meet at least one of the following criteria in order to use Form 3508 EZ:

The Borrower is a self-employed individual, independent contractor, or sole proprietor who had no employees at the time of the PPP loan application and did not include any employee salaries in the computation of average monthly payroll in the Borrower Application Form (SBA Form 2483).

— OR—

The Borrower did not reduce annual salary or hourly wages of any employee by more than 25 percent during the Covered Period or the Alternative Payroll Covered Period (as defined below) compared to the period between January 1, 2020 and March 31, 2020 (for purposes of this statement, “employees” means only those employees that did not receive, during any single period during 2019, wages or salary at an annualized rate of pay in an amount more than $100,000);

— AND —

The Borrower did not reduce the number of employees or the average paid hours of employees between January 1, 2020 and the end of the Covered Period. (Ignore reductions that arose from an inability to rehire individuals who were employees on February 15, 2020 if the Borrower was unable to hire similarly qualified employees for unfilled positions on or before December 31, 2020. Also ignore reductions in an employee’s hours that the Borrower offered to restore and the employee refused.)

— OR—

The Borrower did not reduce annual salary or hourly wages of any employee by more than 25 percent during the Covered Period or the Alternative Payroll Covered Period (as defined below) compared to the period between January 1, 2020 and March 31, 2020 (for purposes of this statement, “employees” means only those employees that did not receive, during any single period during 2019, wages or salary at an annualized rate of pay in an amount more than $100,000);

— AND —

The Borrower was unable to operate during the Covered Period at the same level of business activity as before February 15, 2020, due to compliance with requirements established or guidance issued between March 1, 2020 and December 31, 2020 by the Secretary of Health and Human Services, the Director of the Centers for Disease Control and Prevention, or the Occupational Safety and Health Administration, related to the maintenance of standards of sanitation, social distancing, or any other work or customer safety requirement related to COVID-19.

What is the Covered Period?

The PPP Flexibility Act changed the Covered Period for purposes of the calculations above. (Note there is more than one “Covered Period” in the CARES Act. Here we are talking about the one that refers to when you spend the funds to qualify for forgiveness.)

The Covered Period is either:

(1) the 24-week (168-day) period beginning on the PPP Loan Disbursement Date, or

(2) If the Borrower received its PPP loan before June 5, 2020, the Borrower may elect to use an eight-week (56-day) Covered Period.

For example, if the Borrower is using a 24-week Covered Period and received its PPP loan proceeds on Monday, April 20, the first day of the Covered Period is April 20 and the last day of the Covered Period is Sunday, October 4. In no event may the Covered Period extend beyond December 31, 2020.

What is the Alternative Payroll Covered Period?

Not all businesses’ payroll periods match up perfectly with the date when they receive their PPP funds so there is an Alternative Payroll Covered Period under which the business can spend PPP funds and still qualify for full forgiveness. This is called the Alternative Covered Payroll Period and the instructions describe it this way:

For administrative convenience, borrowers with a biweekly (or more frequent) payroll schedule may elect to calculate eligible payroll costs using the 24-week (168-day) period or for loans received before June 5, 2020 at the election of the borrower, the eight-week (56-day) period that begins on the first day of their first pay period following their PPP Loan Disbursement Date.

For example, if the Borrower is using a 24-week Alternative Payroll Covered Period and received its PPP loan proceeds on Monday, April 20, and the first day of its first pay period following its PPP loan disbursement is Sunday, April 26, the first day of the Alternative Payroll Covered Period is April 26 and the last day of the Alternative Payroll Covered Period is Saturday, October 10.

Borrowers that elect to use the Alternative Payroll Covered Period must apply the Alternative Payroll Covered Period wherever there is a reference in this application to “the Covered Period or the Alternative Payroll Covered Period.”

However, Borrowers must apply the Covered Period (not the Alternative Payroll Covered Period) wherever there is a reference in this application to “the Covered Period” only. In no event may the Alternative Payroll Covered Period extend beyond December 31, 2020.

Filling out the PPP Forgiveness Application Form 3508EZ

If you plan to use this form to qualify for forgiveness, we recommend you print out the PPP Forgiveness Application Form 3508EZ and follow along here. Your lender may use an electronic version of this form but if you have it handy, it won’t hurt to have this information already filled out.

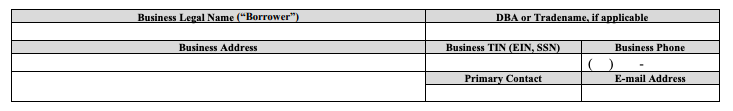

First fill out basic information about your business. Unless your business address has changed, this should be the same as the information you used when you applied for PPP:

SBA PPP Loan Number: ________________________

This is the number assigned by the SBA to your loan. If you don’t have it, ask your lender.

Lender PPP Loan Number: __________________________

Enter the loan number assigned to the PPP loan by the Lender. Again, if you don’t know, ask your lender.

PPP Loan Amount: _____________________________

This is the amount you received.

PPP Loan Disbursement Date: _______________________

Again, this is when the funds were deposited in your bank account. If you received more than one disbursement, use the date of the first one.

Employees at Time of Loan Application: ___________

Enter the total number of employees at the time of the Borrower’s PPP Loan Application. It’s unclear whether self employed individuals with no employees should list themselves here. Check with your lender.

Employees at Time of Forgiveness Application: ___________

Enter the total number of employees at the time the borrower is applying for loan forgiveness. Same question as the previous question.

EIDL Advance Amount: ______________________

If you have received an EIDL advance (grant), enter it here. Note that the advance does not have to be repaid. It is different from an EIDL loan which must be repaid. (The deposit into your bank account would have included the notation EIDG for EIDL grant.)

EIDL Application Number: __________________________

If you applied for an EIDL, enter your application number. If you can’t find your application number, try contacting the SBA Disaster Assistance hotline. If they can’t help, ask your lender for advice on what to do.

Payroll Schedule: The frequency with which payroll is paid to employees is: ☐ Weekly ☐ Biweekly (every other week) ☐ Twice a month ☐ Monthly ☐ Other _____________

Covered Period: _________ to __________

See the instructions in the section above, What is the Covered Period?

Alternative Payroll Covered Period, if applicable: _________ to __________

See the instructions in the section above, What is the Alternative Payroll Covered Period?

If Borrower (together with affiliates, if applicable) received PPP loans in excess of $2 million, check here: ☐

Check the box if the Borrower, together with its affiliates (to the extent required under SBA’s interim final rule on affiliates (85 FR 20817 (April 15, 2020)) and not waived under 15 U.S.C. 636(a)(36)(D)(iv)), received PPP loans with an original principal amount in excess of $2 million. If you received more than $2 million (with affiliates) make sure you review this with your advisors.

Forgiveness Amount Calculations

Payroll and Nonpayroll Costs

Line 1: Payroll Costs

Here you need to enter your payroll costs for the Covered Period or the Alternative Payroll Covered Period. To calculate these costs, you’ll be adding cash compensation, employee benefits and owner compensation (as applicable) and as described as follows in the instructions:

Cash Compensation: The sum of gross salary, gross wages, gross tips, gross commissions, paid leave (vacation, family, medical or sick leave, not including leave covered by the Families First Coronavirus Response Act), and allowances for dismissal or separation paid or incurred during the covered Period or the alternative payroll Covered Period.

For each individual employee, the total amount of cash compensation eligible for forgiveness may not exceed an annual salary of $100,000, as prorated for the Covered Period. For an 8-week Covered Period, that total is $15,385. For a 24-week Covered Period, that total is $46,154 for purposes of this 3508EZ.

You can only include compensation of employees who were employed by the borrower at any point during the Covered Period or Alternative Payroll Covered Period and whose principal place of residence is in the United States.

Employee Benefits: The total amount paid by the Borrower for:

- Employer contributions for employee health insurance, including employer contributions to a self-insured, employer-sponsored group health plan, but excluding any pre-tax or after-tax contributions by employees. Do not add employer health insurance contributions made on behalf of a self-employed individual, general partners, or owner-employees of an S-corporation, because such payments are already included in their compensation.

- Employer contributions to employee retirement plans, excluding any pre-tax or after-tax contributions by employees. Do not add employer retirement contributions made on behalf of a self-employed individual or general partners, because such payments are already included in their compensation, and contributions on behalf of owner employees are capped at 2.5 months’ worth of the 2019 contribution amount.

- Employer state and local taxes paid by the borrower and assessed on employee compensation (e.g., state unemployment insurance tax), excluding any taxes withheld from employee earnings.

Owner Compensation: Enter any amounts paid to owners (owner-employees, a self-employed individual, or general partners). For a 24-week Covered Period, this amount is capped at $20,833 (the 2.5-month equivalent of $100,000 per year) for each individual or the 2.5-month equivalent of their applicable compensation in 2019, whichever is lower. For an 8- week Covered Period, this amount is capped at 8/52 of 2019 compensation (up to $15,385).

Next, you’ll fill out information about nonpayroll costs. You only need to include these if you want to apply for forgiveness for these amounts. If you qualify for full forgiveness based on payroll costs and/or you don’t want to apply for forgiveness based on nonpayroll costs, you can put 0 in Lines 2-4.

Also note that for nonpayroll costs, an eligible nonpayroll cost must be paid during the Covered Period or incurred during the Covered Period and paid on or before the next regular billing date, even if the billing date is after the Covered Period. Eligible nonpayroll costs cannot exceed 40% of the total forgiveness amount. Count nonpayroll costs that were both paid and incurred only once.

Line 2. Business Mortgage Interest Payments:_______

Enter the amount of business mortgage interest payments (not including any prepayment or payment of principal) paid or incurred during the Covered Period for any business mortgage obligation on real or personal property incurred before February 15, 2020. Do not include prepayments.

Line 3. Business Rent or Lease Payments: ______

Enter the amount of business rent or lease payments paid or incurred for real or personal property during the Covered Period, pursuant to lease agreements in force before February 15, 2020.

Line 4. Business Utility Payments:______

Enter the amount of business utility payments (business payments for a service for the distribution of electricity, gas, water, telephone, transportation, or internet access) paid or incurred during the Covered Period, for business utilities for which service began before February 15, 2020.

Potential Forgiveness Amounts

Now comes the fun part. You get to find out whether you qualify for full forgiveness. Hopefully you will!

Line 5. Add the amounts on lines 1, 2, 3, and 4: ________

Line 6. PPP Loan Amount: _______

Line 7. Payroll Cost 60% Requirement (divide Line 1 by 0.60): _____

Divide the amount on line 1 by 0.60, and enter the amount. This determines whether at least 60% of the potential forgiveness amount was used for payroll costs.

Forgiveness Amount

Line 8. Forgiveness Amount (enter the smallest of Lines 5, 6, and 7): _______

That’s the end of the calculation. But, there’s one more thing you’ll need to be aware of. It’s this note in the instructions: “If applicable, SBA will deduct EIDL Advance Amounts from the forgiveness amount remitted to the Lender.” It appears that the EIDL advance (grant) will be subtracted from the amount for forgiveness purposes.

Unfortunately, we’re not done yet. There are three more parts to the application:

- Representations and Certifications

- Documentation

- Borrower Demographic Information (optional)

Representations and Certifications

There is a full list of certifications on page two of the application that the owner will need to initial. We won’t repeat them all here but you should read them carefully and if you have any questions about whether you can answer them affirmatively, talk to your attorney or tax professional.

Documentation

Certain information will have to be documented for the lender. That list is not found on the application but it is included in the instructions. The following documentation requirements come directly from the application.

Documentation That Must Be Submitted With the PPP Forgiveness Application EZ Form

Payroll: Documentation verifying the eligible cash compensation and non-cash benefit payments from the Covered Period or the Alternative Payroll Covered Period consisting of each of the following:

a. Bank account statements or third-party payroll service provider reports documenting the amount of cash compensation paid to employees.

b. Tax forms (or equivalent third-party payroll service provider reports) for the periods that overlap with the Covered Period or the Alternative Payroll Covered Period:

i. Payroll tax filings reported, or that will be reported, to the IRS (typically, Form 941); and

ii. State quarterly business and individual employee wage reporting and unemployment insurance tax filings reported, or that will be reported, to the relevant state.

c. Payment receipts, cancelled checks, or account statements documenting the amount of any employer contributions to employee health insurance and retirement plans that the Borrower included in the forgiveness amount.

d. If you checked only the second box on the checklist on page 1 of these instructions, the average number of full-time equivalent employees on payroll employed by the Borrower on January 1, 2020 and at the end of the Covered Period.

Nonpayroll: Documentation verifying existence of the obligations/services prior to February 15, 2020 and eligible payments from the Covered Period. (Remember this only applies if you included nonpayroll expenses in the amount for which you are trying to seek forgiveness.)

a. Business mortgage interest payments: Copy of lender amortization schedule and receipts or cancelled checks verifying eligible payments from the Covered Period; or lender account statements from February 2020 and the months of the Covered Period through one month after the end of the Covered Period verifying interest amounts and eligible payments.

b. Business rent or lease payments: Copy of current lease agreement and receipts or cancelled checks verifying eligible payments from the Covered Period; or lessor account statements from February 2020 and from the Covered Period through one month after the end of the Covered Period verifying eligible payments.

c. Business utility payments: Copy of invoices from February 2020 and those paid during the Covered Period and receipts, cancelled checks, or account statements verifying those eligible payments

Documents that Each Borrower Must Maintain but is Not Required to Submit

Note that you have to keep this documentation for six years after the loan is forgiven or repaid. So find a safe place to keep it where you’ll be able to access it if needed.

Documentation supporting the certification that annual salaries or hourly wages were not reduced by more than 25 percent during the Covered Period or the Alternative Payroll Covered Period relative to the period between January 1, 2020 and March 31, 2020. This documentation must include payroll records that separately list each employee and show the amounts paid to each employee during the period between January 1, 2020 and March 31, 2020, and the amounts paid to each employee during the Covered Period or Alternative Payroll Covered Period.

Documentation regarding any employee job offers and refusals, refusals to accept restoration of reductions in hours, firings for cause, voluntary resignations, written requests by any employee for reductions in work schedule, and any inability to hire similarly qualified employees for unfilled positions on or before December 31, 2020.

Documentation supporting the certification, if applicable, that the Borrower did not reduce the number of employees or the average paid hours of employees between January 1, 2020 and the end of the Covered Period (other than any reductions that arose from an inability to rehire individuals who were employees on February 15, 2020, if the Borrower was unable to hire similarly qualified employees for unfilled positions on or before December 31, 2020). This documentation must include payroll records that separately list each employee and show the amounts paid to each employee between January 1, 2020 and the end of the Covered Period.

Documentation supporting the certification, if applicable, that the Borrower was unable to operate between February 15, 2020 and the end of the Covered Period at the same level of business activity as before February 15, 2020 due to compliance with requirements established or guidance issued between March 1, 2020 and December 31, 2020 by the Secretary of Health and Human Services, the Director of the Centers for Disease Control and Prevention, or the Occupational Safety and Health Administration, related to the maintenance of standards of sanitation, social distancing, or any other work or customer safety requirement related to COVID-19. This documentation must include copies of the applicable requirements for each borrower location and relevant borrower financial records.

All records relating to the Borrower’s PPP loan, including documentation submitted with its PPP loan application, documentation supporting the Borrower’s certifications as to the necessity of the loan request and its eligibility for a PPP loan, documentation necessary to support the Borrower’s loan forgiveness application, and documentation demonstrating the Borrower’s material compliance with PPP requirements.

The Borrower must retain all such documentation in its files for six years after the date the loan is forgiven or repaid in full, and permit authorized representatives of SBA, including representatives of its Office of Inspector General, to access such files upon request.

This article was originally written on June 17, 2020 and updated on June 18, 2020.

great nav thru this only question is what is the web site do I send it to?

You apply for forgiveness through the lender that gave you your PPP loan.

Hi, 2 days ago I filed my PPP EZ application with PDF download application but I don’t know how to send back to them please help me.

You’ll need to ask your lender how to apply for forgiveness.

Once finished with the 3508EZ form is there a mailing address you know of to send it too? Can we fill out online, submit online, and what is that website address?

Hi Sean – You’ll file for forgiveness with your lender. They may provide an online form but if you’ve filled the paper one out it should be easy!

Once we fill the form for SBA-PPP loan forgiveness, who/which address should we send the forms to.

Ahmad – You will submit it to the lender who gave you your PPP loan.

Hello, on the form 3508EZ, I am not understanding the forgiveness amount calculation.

Line 8 says “Forgiveness Amount (enter the smallest of Lines 5, 6, and 7):”

If my PPP loan was $20,000, and $12,000 was paid to payroll (60%), and the remaining $8K to other eligible expenses, then according to the application instructions, my forgivable amount would only be 60% of the $12,000 used for payroll, or $7,200 (assuming that is the smallest amount of lines 5, 6, and 7). So is that correct? On a $20,000 PPP loan where ALL of the funds were used for eligible expenses, only $7,200 is forgivable?

That doesn’t seem to make any sense. Can you explain please? Or if I am mistaken in my understanding, please explain where I am in error please?

Thank you,

Ted

Based on what you’re saying, Line 1 is $12000. On lines 2-4 you have $8000. Line 5 totals lines 1-4 so it’s $20000. Line 6 is $20000. Line 7 is also $20000 ($12000 divided by .60 – not multiplied). You enter the smaller of lines 5-7 on line 8 and since they are all the same you enter $20,000. That’s 100% forgiveness. Don’t ask me how the math works (the line 7 calculation threw me too) but that’s how the instructions work and the end result seems to make sense!

I’m not an accounting professional so please don’t rely on my calculations for forgiveness.

Thanks for your web page.

I worked as Real Estate Agent as contractor what possibilities I have to qualify for PPP forgiveness?

Thanks.

John

It doesn’t matter what type of work you do. What matter is how and when you spend the PPP funds.

Line 7 is confusing. Payroll cost of 60% is not the same as payroll cost divided by 0.6

For example. if payroll cost is $10,000, 60% is $6000, but $10,000 divided by 0.6 is $16,666.

which one is correct, $6000, or 16,666?

Thanks

It is confusing! Make sure you follow the instructions and divide by .60 – don’t multiply.

Thanks for this page!

I’m a rideshare driver, listed as “self/Uber/Lyft “ on the loan paperwork. I have been approved, but am unsure if I officially qualify, and haven’t yet signed. The amounted awarded just about covers what I make in twelve weeks. Can I take the loan amount as 100% towards payroll (i.e. let it deposit in my personal bank account) and be done? If so, what will I need to submit when I apply for forgiveness? I haven’t been working since March, and don’t anticipate doing so after I receive the loan.

My lender cannot or will not return my emails or phone calls.

Thx!

Jonathan,

You will have to fill out the forgiveness application as described in this article. The application doesn’t fully explain documentation requirements for a self-employed person who files schedule C but in other guidance it appears that the 2019 Schedule C will suffice. We covered that in more detail in this article: Self Employed: How to Fill Out the PPP Loan Forgiveness Application

I heard if one has two self-employed sole proprietor businesses (i.e. 2 Schedule C’s) filed under the same SSN, same 1040, one can apply for two PPP’s. Or….can they be combined into one PPP? Can you please confirm? Thanks!

You can only get one PPP loan and since you use the same SSN to apply it makes sense you will need to apply for one loan based on both. But you’ll have to talk to the lender – ultimately they process the application.

Thank you, so much, Gerri!

You’re so welcome!

we have 30 full time employees and we did not reduce any wages or head count or any individual’s weekly 40 hours, but did reduce overtime for most employees. Does that mean we cannot use Form 3508-EZ ?

We have no rent and minimal utilities. I assume we should use the 24 week period no matter what? our PPP loan was 507,000 and after 8 weeks our forgivable amount is only about 310000 (assuming no forced reduction) so we can just keep going until we hit the 507000 in a 6 weeks or so from now ?

Regarding your questions, Treasury and SBA have not issued any further guidance beyond what’s in the application and the instructions so there are still many unanswered questions.

First, I don’t see any mention of overtime in either so I can only assume it is not treated differently for purposes of which form you use, however I don’t know for certain.

Second, if you received your loan on or before June 5th 2020 you can use either the 8-week or 24-week period. If you received your loan after that date the instructions state to use the 24-week period.

24 weeks doesn’t match the loan amount (which was based on 2.5 times monthly payroll – roughly 10 weeks) so the amount of PPP funding isn’t going to last the full 24 weeks without reducing salary and/or headcount: However, Tony Nitti, a CPA who has written about this for Forbes states: “Here’s where the advantage of the PPP Flexibility Act becomes obvious: PPP loans were made based on 2.5 months of the borrower’s average monthly payroll costs for 2019. Now, borrowers will get 24 weeks —or nearly six months — to incur forgivable payroll costs. Thus, for many borrowers, the total “forgivable” costs will far exceed the loan proceeds; as a result, even if the borrower finds itself subject to a reduction in the forgivable amount because of reduced salary or headcount, the math is such that even AFTER the reduction, the forgivable costs will exceed the principal balance of the loan.”

I’m sorry I can’t be more specific. I do think it’s important to consult an accounting professional, especially given the complexity involved with 30 employees and overtime pay.

You did not get it correct. The form reads as follows as compared to during the covered period.

The Borrower was unable to operate between February 15, 2020, and the end of the Covered Period at the same level of

business activity as before February 15, 2020 due to compliance with requirements established or guidance issued between

March 1, 2020 and December 31, 2020, by the Secretary of Health and Human Services, the Director of the Centers for

Disease Control and Prevention, or the Occupational Safety and Health Administration, related to the maintenance of

standards of sanitation, social distancing, or any other work or customer safety requirement related to COVID-19.

The Borrower’s eligibility for loan forgiveness will be evaluated in accordance with the PPP regulations and guidance issued by

Rich – I’m always happy to make corrections but I can’t ascertain what you are talking about. I’ll send you an email.

Hello Ms. Detweiler,

your article & explanation is super helpful.

But I do not understand 1 point.

In my situation, I will run out of the PPP amount in my 15th payroll…as I understand I can either choose 8 weeks or 24 weeks.

I picked 24 weeks, the total payroll amount is over the loan amount and when I do the calculation on it, the amount dont make sense.

For example:

Loan amount 2MM

Line 1: 24 weeks’ payroll cost $2.8MM

Line 7: 60% requirement: (divide line 1 by 0.60) $2.8MM divided by 0.60 =$4,666,6666?

Please advise…I am confused.

Thank you for your time.

Lydia,

I strongly encourage anyone who is having trouble filling this out to work with an accounting professional.

Generally speaking, though, the 24-week payroll and the loan amount won’t match up. (The loan amount was based on roughly 10 weeks of payroll not 24).

If I understand your question, you’re trying to figure out if you qualify for maximum forgiveness. I don’t know whether you have employees so I don’t know what you’d put in Line 8 of the Forgiveness Calculation Form but remember you’re looking for the smaller number of Lines 8, 9 and 10. If the smaller number is the loan amount (line 9) then you qualify for full forgiveness.

I found this explanation in a Forbes article by Tony Nitti helpful:

Here’s where the advantage of the PPP Flexibility Act becomes obvious: PPP loans were made based on 2.5 months of the borrower’s average monthly payroll costs for 2019. Now, borrowers will get 24 weeks —or nearly six months — to incur forgivable payroll costs. Thus, for many borrowers, the total “forgivable” costs will far exceed the loan proceeds; as a result, even if the borrower finds itself subject to a reduction in the forgivable amount because of reduced salary or headcount, the math is such that even AFTER the reduction, the forgivable costs will exceed the principal balance of the loan.

Great article! If we qualify for the EZ form, can we still use the full form anyway? I’m more comfortable that way.

It appears to be optional not mandatory. However, ultimately you’ll apply through your lender so I’d recommend you check with them.

Serious question here, your blog’s description after Line 7 is:

“Divide the amount on line 1 by 0.60, and enter the amount. This determines whether at least 60% of the potential forgiveness amount was used for payroll costs.”

But line 1 was payroll costs for the covered period, not the loan or proceeds amount. So this would make the forgiveness only 60% of the reported payroll, it seems like there is a serious error by SBA here? Any thoughts, am I following this right?

It’s divide by .60 not multiply. I struggled with that too but the numbers seem to work.

I should add that’s the language from the application and instructions.