When Calvin first started tracking his credit scores with his Nav account, he was struck by how much his personal credit score would fluctuate from month to month. In the first four months he monitored it, his score went up 52 points, down 42 points then back up again by 46 points. (All of these changes were in relation to his original score.) He wasn’t doing anything crazy like opening a bunch of new cards to earn credit card rewards, nor had he paid anything late. It seemed his credit scores were moving in conjunction with one major factor: his credit card balances.

Calvin saw firsthand how a factor called “debt usage” or “utilization” can quickly increase — or deflate — credit scores.

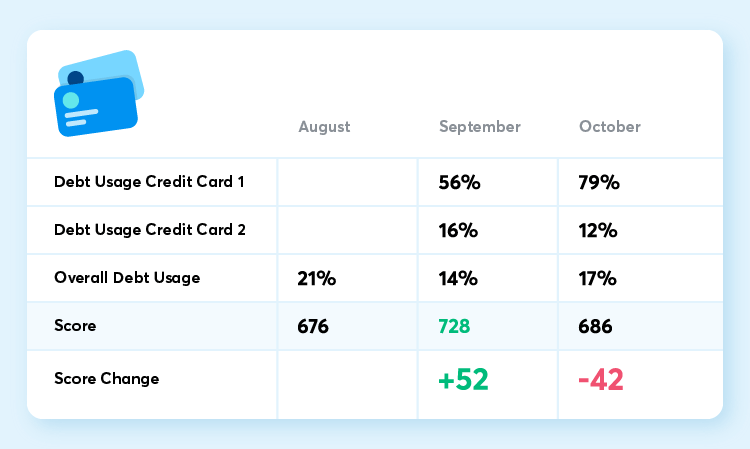

For example, here’s what happened to Calvin’s scores as his utilization changed:

How It Works

Debt usage compares balances to credit limits on revolving accounts such as credit cards and lines of credit. Suppose you have a credit card with a credit limit of $1,000, and your card issuer reports to the credit bureau that your balance is $500. You’re debt usage ratio is 50%. If instead your reported balance is $200, your debt usage ratio is 20%.

There is no perfect debt usage ratio, but generally lower is better and once it starts creeping above 20-25%, you may start to see it impact your credit scores. Some consumers find that paying down high-balance credit cards (reducing debt usage) can improve their credit scores quickly.

Debt usage is calculated both in the aggregate (the total of all credit limits compared to all balances) and on individual accounts. Notice in Calvin’s example there is a figure for total debt usage. In September it drops by 7 percentage points and his scores jump considerably. In October it’s higher, and his score is closer to the original score.

But those relatively small changes in his overall debt usage probably aren’t driving those big swings. Instead, what’s more interesting here is the debt on his two credit cards. In October, his debt usage on his first credit card jumps to 79%. That’s considered very high and his credit score drops quite a bit that month. It’s lower in September (56%) and his score is much better.

It’s worth noting that a debt usage ratio of 56% is still on the high side. If it were lower, he may have had even an even better score, though other factors such as age of credit, credit mix and applications for new credit impact his scores as well.

Coping Strategies

For those who check their credit scores and discover their debt usage ratios are high (you can check your personal and business credit scores for free at Nav), here are some strategies that can bring that number down:

- Pay down debt. This is the ultimate strategy since it saves money by reducing interest costs and keeps balances from compounding.

- Pay your bill before it’s due. Even if you pay in full each month, your balance can still affect you. That’s because many issuers report statement balances to the consumer credit reporting agencies and many consumers will do something pretty smart — wait to pay those statement balances until they’re due, giving them a long, interest-free grace period to pay for their purchases. If you’re consistently brushing up against that limit when your statement balance is issued, however, forgoing some of that grace period and paying before your statement balance is reported can lower your debt usage and impact your credit score. (If you’re a business owner, the strategy of paying bills early can be even more important for building good business credit scores. In the Paydex model, for example, you can only achieve the highest scores by paying bills before they are due.)

- Consolidate. For those who don’t have extra cash lying around, consolidating high credit card balances can potentially save money and bring down debt usage. Personal installment loans (those with a fixed monthly payment) aren’t treated the same way when it comes to debt usage.

The Caveats

A few things to keep in mind if you are worried about your debt usage:

- Credit scoring models are complex, and there are many different ones lenders can use, so individual results may vary. Someone could follow the same exact debt usage ratios as Calvin’s and their scores could change by different amounts, because of all the other information in their credit reports.

- Credit reports and scores are created when they are requested. The information available at the time the report or score is requested is what will be used to calculate the score. Lenders report at different times of the month, though most report around the time the billing cycle for that card ends. You can check your issuer’s reporting date by comparing the balance on your credit report with your most recent credit card statement.

While this is just one of the major factors that goes into credit scores, it can be an important one. Paying on time, keeping debt low and opening new accounts carefully can be key ways to help maintain strong credit.

This article was originally written on July 12, 2017 and updated on July 21, 2017.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.