Advertiser & Editorial Disclosure

This post was reviewed and updated on June 15, 2020.

Strong personal and business credit scores can help small business owners qualify for better financing which, in turn, can help them grow their business. But not every entrepreneur can afford to wait until their credit is in perfect shape before they launch. Some have damaged credit due to financial setbacks, while others may have avoided debt and have very little credit history.

That’s where Self, formerly known as Self Lender, may help. It offers a low-risk way for entrepreneurs to build a better personal credit score by adding a positive credit reference to their credit reports, without the temptation of running up balances on credit cards.

Who May Benefit from Self

Self isn’t specifically geared toward business owners and it doesn’t build business credit. (To build business credit you need accounts that report to commercial credit agencies.)

As a small business owner, personal credit will likely be a part of any business creditworthiness evaluation, including most small business credit card issuers. Bad credit, or less-than-perfect credit can make it difficult to qualify for a personal loan and can increase the interest rate a borrower might pay on a loan they do qualify for.

What’s more, the FICO SBSS score, which is used to pre-screen applications for one the most popular SBA loan programs, takes into account the owner’s personal credit along with business credit information. So for many entrepreneurs, personal and business credit are closely intertwined. This also applies to most small business loans outside of the SBA too.

A survey by Nav found almost 40% of its small business customer base were “credit ghosts,” and had so little credit history that getting financing could be difficult. Self Lender can be a way to help develop a more robust credit history.

It may also be helpful for those who want to start a small business in the future. One of these accounts can provide a disciplined framework to build credit while creating a small savings account that can then be used to help cover the cost of basic start up tasks that can help get a business off the ground. (Here’s a checklist of 14 steps to make your business legitimate.)

How It Works

Self offers “credit builder” accounts. This means you essentially “borrow” a CD (in this case, an FDIC-insured certificate of deposit bank account) and pay for it by making 12 or 24 monthly payments. At the end of that time period, you have full access to the money in the savings account, plus a credit reference on your personal credit report with Equifax, Experian and TransUnion.

Self will conduct a “soft inquiry” into your credit and payment history when you become a member so that it can provide free credit monitoring. Soft inquiries do not affect your credit scores. In addition, the bank that Self partners with will conduct a credit check with ChexSystems, which collects and reports information about closed checking and savings account. (You can check your Chexsystems report here for free.)

Monthly payments made on your Self account will be reported to all three major credit reporting agencies (Experian, Equifax, and TransUnion). A monthly payment that is more than 30 days late will be reported as a late payment so you want to pay your account on time, just as you would with any other account that can impact your credit.

A credit builder installment loan can be a complement to a secured credit card, which is another way to add a credit reference to your credit reports. Self accounts are categorized as “installment loans,” which is different than “revolving accounts,” which is the category credit cards fall under. Having different types of credit accounts can impact the “credit mix” factor which makes up about 15% of credit scores.

Self: The responsible way to build credit

How to Apply for a Self Loan

The application for a Self Credit Builder Loan is a simple online form that asks for some basic information like your full name, address, phone, and social security number (remember, you are setting up a savings account, agreeing to loan terms, and otherwise setting up a banking relationship which will require this information). To complete the application you will need to determine whether or not you want to opt for $25 per month, $28 per month, $89 per month, or $150 per month. The application only takes a couple minutes to complete after which you will be prompted to call in to a Self representative to go through some disclosure information to complete the application.

Self Credit Builder Costs

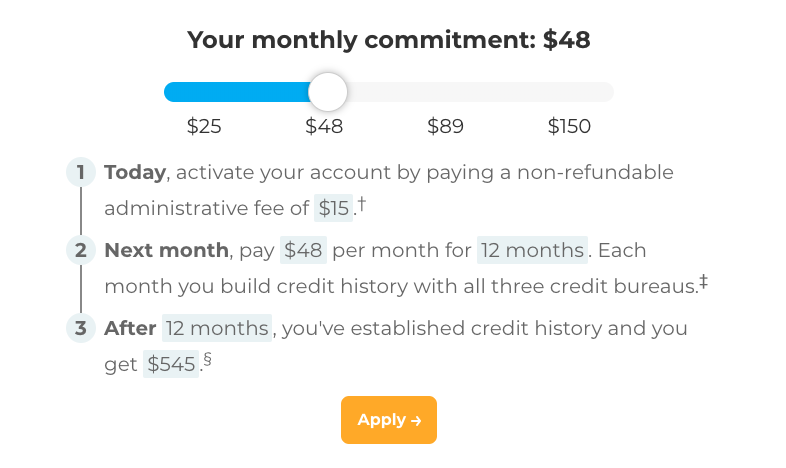

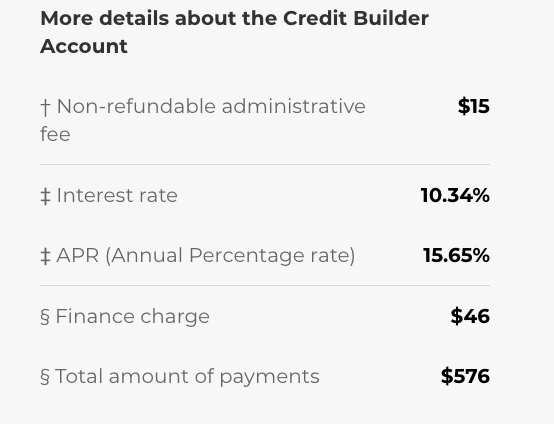

You can start your credit builder account with Self for just $25 a month, but you can also choose monthly payments of $48, $89 or $150. The payment period for a $25/month account is 24 months, while the others require payments over a 12-month period. The larger your monthly payments, the more you’ll have in your savings account at the end of your repayment period.

There is a non-refundable administrative fee of $9—$15 when you open your account. The APR ranges from 12.03%—15.65%.

The site offers an easy-to-use calculator that will help you understand the cost of your loan. For example, let’s say you want to make monthly payments of $48. After twelve months of making those payments, your savings account will be worth $545 and you will have paid Self Lender a total of $576 ($46 in finance charges includes the $15 administrative fee.)

Here is a screenshot of the example above from the Self Lender website on July 18, 2018:

Credit Builder Loans vs. Secured Credit Cards

Both a Credit Builder loan and a secured credit card can be tools to help build credit or strengthen a weak credit profile, but they take different approaches. Both will help build a track record of successful loan payments.

The Credit Builder loan enables you to make regular monthly payments that result in a personal savings account of between $500 and $1500 at the end of the loan term. These funds are locked away in the account until the loan term expires. Your payment history will be reported to the personal credit bureaus and once the loan term is over, you will have access to the funds and be able to use them for whatever you would like.

A secured credit card will also help you build personal credit, but instead of making payments into a savings account you will have access to at the end of the term, you pay a security deposit to the card issuer that secures the credit and becomes your credit limit. The card provider will also report your payment history to the credit bureaus, and over time, as you make timely payments, your available credit limit will likely increase.

You should consider which option makes the sense to help you achieve your goals.

Self Review: The Verdict

Self offers consumers and business owners a reasonably priced option for adding a credit reference to their credit reports—a savings account at the end is an added perk. Business owners who could benefit from building out their credit history may want to look more closely at this option. As with all accounts that appear on credit reports, paying on time is critical for maintaining a positive payment history.

This article was originally written on July 11, 2018 and updated on June 15, 2020.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.