A few months ago, in the process of putting final touches on my newest book, Finance Your Own Business: Get on the Financing Fast Track, I touched base with Levi King, CEO of the company that was then known as Creditera. We had last talked about 18 months prior, and I had found his company’s efforts to help business owners understand and manage their business credit scores and profiles intriguing enough to mention them in the book. I wanted to find out if anything had changed.

The answer was yes, it had. He described improvements in their tools and after the call, I signed up for a free Nav account. Seeing what they now offered – a clear and easy-to-understand snapshot of both my personal and business credit – I was blown away. I had been following small business credit for more than ten years, knew how confusing it could be, and immediately saw how using these tools could change that. I shot my coauthor, attorney Garrett Sutton, an email saying that we had to make sure we told our readers about them.

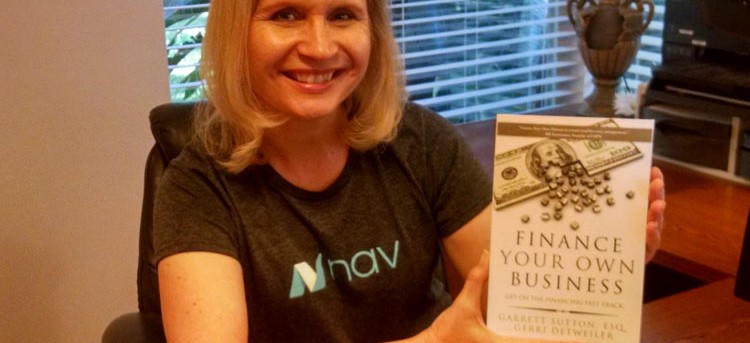

It’s now a couple of months later and my book Finance Your Own Business is launching soon. (If you’re interested, the coupon code for 31% off plus free shipping is FYOB2015). It recommends Nav–the new name for Creditera. But I am doing more than just telling my readers about it.

I’ve recently joined the Nav team as head of market education and couldn’t be more excited. It turns out we both share a similar vision.

I’ve been involved in credit education for more than two decades and my first book, The Ultimate Credit Handbook, was one of the first (if not the first) to explain FICO scores. At the time, consumers had little information about credit scores and neither the credit reporting agencies nor Fair Isaac were very interested in providing that information to consumers. Their customers were lenders and decision makers, not individual consumers. Things there have definitely changed.

Business credit scoring today reminds me of where consumer credit scoring was then. Ask a business owner what their FICO score is today and they are more likely to respond with their personal FICO score than with their FICO SBSS business credit score,< even though it’s the latter that will play a key role if they apply for an SBA loan.

Beyond that, entrepreneurs have probably heard of D&B, and may even know their businesses’ Paydex score, but they probably can’t name the top business credit reporting agencies, or how each of them view their business credit. A survey earlier this year by Nav found that 45% of small business owners don’t know they have a business credit score and 82% don’t know how to interpret their score.

Just as we saw a surge in credit card offers featuring low rates and rewards over a decade ago, there has been a recent explosion of SMB financing and lending options. But if anything, that’s left business owners more confused and overwhelmed. Nav wants to change that by being a small business advocate and partner, helping business owners identify the options that will work best for them.

My career started in Washington DC with a non-profit advocacy group. I had the opportunity to work alongside and learn from some dedicated individuals and organizations. Since then, no matter what I’ve done, I’ve always found myself motivated by wanting to help people succeed. That makes this the perfect fit for me. Nav wants to help small business owners succeed, and since we’re not a lender–and don’t work for them–we can help steer you away from bad deals and toward the good ones. (Nav was also the first non-lender to sign the Small Business Borrower’s Bill of Rights. The advocate in me loved that.)

Are you running, or hoping to run, a small business? As part of my work here I’ll be helping to educate entrepreneurs on how to understand and maintain their credit and financial health. Whether you have an established business or are planning to launch one, Nav wants to help you. We want to be your one-stop resource for small business tools, financing, and credit profiles that help you run more efficiently and access the business services and financing you need. If you have questions, we’re all here to help!

This article was originally written on November 2, 2015 and updated on November 2, 2016.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.