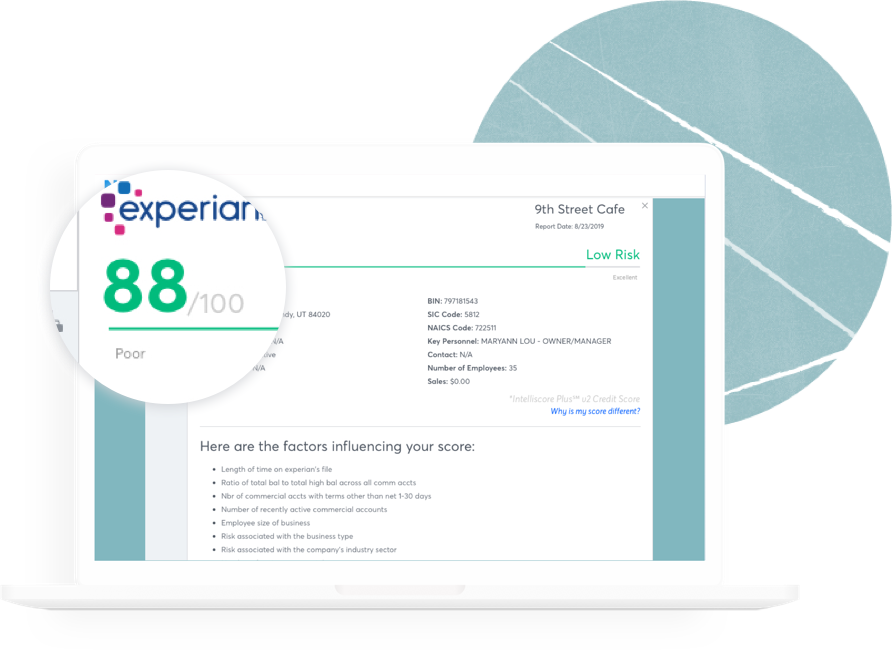

What the stuff at the top of your business credit report means

As a business owner, you want to check and verify that Experian and all the reporting companies list the information in your credit file accurately. There are credit monitoring services available that will do this for both your business and consumer credit profiles.

The stuff at the top of your Experian credit reports means something to prospective lenders. The major business credit bureaus all list this information at the top of your credit profile. Here are what the acronyms stand for and why credit managers care.

1. Business address:

Your business address needs to be accurate for lenders to verify it’s the correct business. Double-check this information and make sure your name and address are exact.

2. Date founded:

The date founded listed on your report tells lenders how long you’ve been in business officially.

3. Incorporation date:

Lenders will check to see if you’ve incorporated. If you have, the date you incorporated will show here. If you haven’t, it will say N/A. Lenders prefer it if you’ve incorporated.

4. Current status:

Current status refers to the overall payment performance status of the currently reported period.

5. Business type:

Your business type tells lenders if you’re a sole proprietor, LLC, C-Corp, etc.

6. BIN:

BIN stands for your bank identification number. This number is like your social security number, but for your business.

7. SIC code:

The Standard Industrial Classification classifies your industry with a four-digit code. Your business needs to have the correct codes listed because different industries have different credit risk classifications. Lenders want to know if you’re one of these. If your company is considered a higher risk, you may have a harder time qualifying for financing.

8. NAICS code:

The North American Industry Classification System is a more modern version of the SIC code and is widely used today by the US, Canada, And Mexico to classify your business by its industry.

9. Key personnel:

The North American Industry Classification System is a more modern version of the SIC code and is widely used today by the US, Canada, And Mexico to classify your business by its industry.Key personnel are the people in your company who have authority and responsibility for planning, directing, and controlling your company’s activity; i.e., the owner or CEO, COO, CLO. Banks want to know whose steering the ship.

10. Contact:

When you incorporate, you’ll be asked to list an individual who receives legal documents like a court summons in the event of a lawsuit. Make sure the person you choose is reliable and will get you any mail they receive on time. You need to respond to legal documents on time. Also, they may receive other bits of mail that were meant to go to the company address.

11. Number of employees:

Lenders will look to see how many employees you have as it will give them an idea of the size of your company.

12. Sales:

Your sales are your firm’s annual revenue. Like the other information on your report, ensure this is accurate.

1. Payment history

Your payment history has a significant impact on your company’s credit profile. You must pay on-time.

2. Delinquent payments

Delinquent payments have a significant impact on your business credit score. Your delinquencies in the past three months have the most impact. Of course, it’s best not to have any, but life happens. Do your best to always pay your business loans, credit cards, and vendors on time, or early if possible.

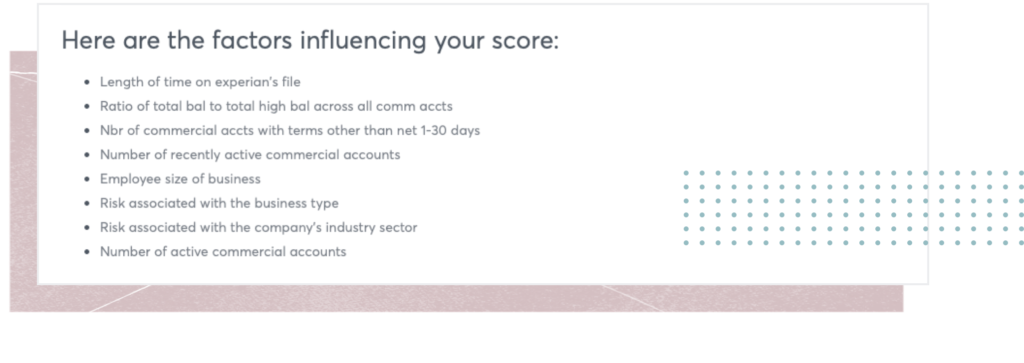

3. Rick associated with your business type

Prospective Lenders view certain types of businesses as high risk. If your company is involved in real estate investing, auto sales, travel, transportation, money lending and collecting, or if you own a restaurant, you’ll be considered a high credit risk. It will be more challenging for your company to get a business loan.

4. Industry sector

There are four types of industry sectors. Businesses that exploit natural resources, businesses involved in manufacturing or construction, organizations that provide services, and R&D and consulting. This section will tell lenders your firm’s sector.

5. Years in business/age of your credit profile

Lenders want to know how long you’ve been in business. In theory, the longer you’ve been in business, the more established your business credit profile should be. The longer, the better. Once you’ve been in business for two years, your odds of approval improve. For some lenders, two years in business in a minimum requirement.

6. Inquiries

How many lines of credit have you applied for or opened in the last nine months? When you apply for a loan of any kind, the lender will request your credit report. That’s known as an inquiry. Inquiries can hurt your credit report.

Don’t panic. If you want to build a solid business credit profile, inquiries are unavoidable. For example, when you apply for a business credit card or loan, there will be an inquiry from the credit card issuers or lenders where you applied. To keep them to a minimum, ensure you meet the criteria for approval before you apply.

Keep in mind; you may need to provide your social security number and sign a personal guarantee until you’ve built enough business credit. So your consumer credit scores will affect your odds of approval. Make sure the consumer credit reporting agencies have your personal credit file right. If your credit history isn’t accurate, it could hurt your odds of approval. Check all three major credit reporting bureaus.

7. Collections and liens

If you have any collection accounts or tax liens on your credit in the past seven years, those harm your business credit scores.

8. New lines of credit opened

The number of accounts, or lines of credit, you’ve opened recently can negatively impact your credit score. These include credit cards, equipment leases, inventory financing, and IT equipment leasing.

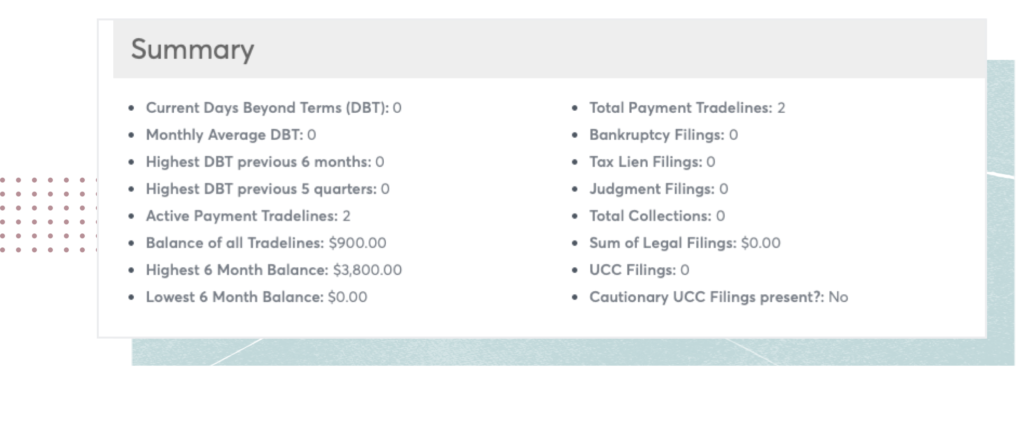

1. Current days beyond terms

DBT shows if you were late and how many days late you were late on a payment. Ideally, you want your payment history to reflect zero late payments.

2. Monthly average DBT

Monthly Average DBT refers to your monthly average of days beyond terms. Strive for this to be zero.

3. Highest DBT previous 6 months

Highest DBT refers to the highest number of days beyond terms recorded in the last six months.

4. Highest DBT previous 5 quarters

This section is similar to your highest Highest DBT Previous 6 Months number, but it’s for your previous five quarters.

5. Active payment tradelines

Your active payment tradelines denote how many tradelines you have open and are regularly paying.

6. Balance of all tradelines

Balance of All Tradelines refers to the total sum of all your open tradelines. It shows prospective lenders your credit utilization.

7. Highest 6 month balances

Highest 6 Month Balances is your highest balance across all your tradelines in the past six months. It’s how much of your credit limit you’ve used.

8. Lowest 6 month balances

And this refers to your lowest balance across all your tradelines in the past six months.

9. Total payment tradelines

This field lists how many tradelines show in your Experian credit report. Lenders want to see how many accounts you’ve had and paid in total, so they know how well you pay your creditors.

10. Bankruptcy filings

If your company has ever filed bankruptcy, it will show here.

11. Tax lien filings

Any tax liens filed against your company will appear under this heading. Lenders usually view tax liens as a negative.

12. Judgement filings

If your business has been involved in lawsuits and lost, a judgment is filed against your company and listed here.

13. Total collections

If you couldn’t pay an account and it went to collection, lenders will see it listed under this section. It gives lenders an idea of your financial health over time.

14. Sum of legal filings

If you have UCC filings against your firm, the sum of legal filings will list the total amount in dollars of the liens.

15. UCC filings

A UCC filing against your business denotes a lien that one of your creditors may have placed on your assets.

16. Cautionary UCC filings present? Yes or no

This section indicates whether your company has pledged vital assets. Such as accounts receivable, contracts, acquired inventory, leases, notes receivable, or proceeds to secure your financing.

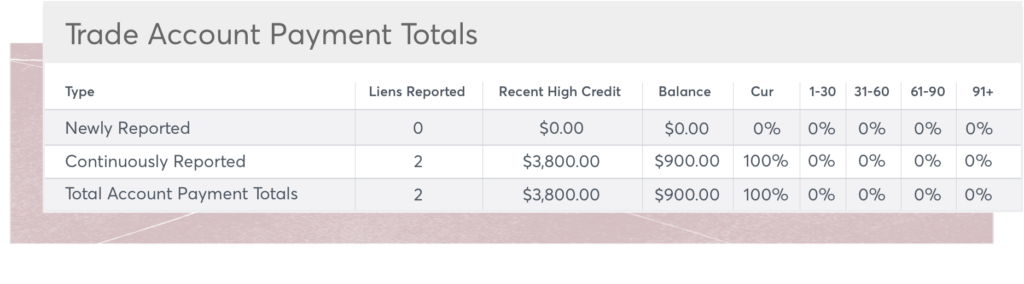

1. Continuously reported

Continuously Reported refers to how many of your trade lines are constantly reporting to the business credit bureaus. To build business credit, it’s vital you ensure you have tradelines that report to experian and the other primary bureaus. Strive to acquire multiple, aged tradelines.

2. Newly reported

Newly Reported denotes any recent tradelines you’ve established if they’re reporting to the business credit agencies.

3. Trade line totals

Trade Line Totals tells lenders the total number of tradelines you have that are reporting to the business credit bureaus.

4. Liens reported

If you’ve ever had claims filed against your company, Liens Reported will give lenders information about them.

5. Recent high credit

Recent High Credit Recent High Credit shows your highest account balance your creditors have reported in the last 12 months. It gives lenders a perspective on your credit utilization. Lenders will be more likely to approve you if you keep your credit utilization low.