The Dun & Bradstreet PAYDEX Score Explained

by Gerri Detweiler

What is the PAYDEX score?

The PAYDEX® score is a business credit score that’s generated by Dun and Bradstreet (D&B). Their model analyzes a business’ payment performance (i.e., if it pays its bills on time) and gives it a numerical score from 1 to 100, with 100 signifying a perfect payment history.

Just like a consumer’s creditworthiness hinges on a FICO score, a business’s creditworthiness is determined by a scoring system as well. One business credit score that is typically used by lenders, vendors, and suppliers to judge whether a business is qualified for different financing products is the PAYDEX score.

A business’ D&B PAYDEX score is used much like an individual’s FICO score. It helps lenders, vendors and suppliers determine whether to approve you for financing and on what terms. Typically, the better the score, the more generous the terms extended. This can save your business money and give you more time to pay for supplies or services, leveling out cash flow.

In order to establish a PAYDEX score, you’ll need a Dun & Bradstreet number, or a DUNS number.

What is A Good PAYDEX Score?

The PAYDEX score ranges from 1 to 100. Maintaining a PAYDEX score of at least 75 shows lenders, vendors, and suppliers that you’re relatively low risk and likely to make repayments on time. A score below 75 may indicate you have a high risk of late payments, and a score below 40 is poor.

Read on for more on how scores are calculated and what each score range indicates about your ability to make payments.

How is My PAYDEX Score Calculated?

To determine your business’s PAYDEX score, Dun & Bradstreet gathers data from the suppliers and vendors with which you do business over a rolling 12-month period. Each supplier/vendor is considered a tradeline account, and the payments you make to that supplier/vendor is considered a payment experience. According to Dun & Bradstreet, two tradelines with at least three credit experiences are needed for a PAYDEX score; however, in Nav’s experience, business owners need at least three tradelines reported to create a score.

Dun & Bradstreet analyzes the promptness of your payments against the terms of sale for each payment experience. So, the faster you pay your bills, the better your score.

PAYDEX scoring is dollar-weighted, which means that each payment experience is weighted in terms of the number of transactions and the overall dollar value of those transactions. That means your transactions with your IT vendor, with whom you spend thousands of dollars monthly, comprise a greater percentage of your D&B PAYDEX score than your transactions with the carpet cleaner who comes out to steam your rugs annually for a few hundred dollars, for example.

It’s important to note that a Dun & Bradstreet PAYDEX score of 100 does not indicate that a business has made on time payments — in fact, it indicates that a business has consistently paid suppliers 30 days in advance. Here’s a breakdown of what your Dun and Bradstreet number means:

How is My PAYDEX Score Used?

PAYDEX is primarily used by vendors and suppliers to judge your business when determining what terms to extend on trade credit (e.g., net 30, net 60, etc.) This is important because having more time to pay your bills can help you better manage cash flow.

Lenders and creditors can also consider your PAYDEX score before extending lines of credit or loans to your business. You should aim to maintain a PAYDEX score of 75 or higher to ensure qualification for these types of financing.

How Can I Improve My D&B PAYDEX Score?

Since your PAYDEX score is based entirely on the promptness of your payments to vendors and suppliers, the only way to improve it is to make sure you are paying on time. Remember: paying on time will only earn you a score of 80. For a perfect PAYDEX score of 100, you need to pay early.

You should also make sure you have at least three open tradelines to generate a PAYDEX score on your business. Having no PAYDEX score is just as bad as having a low one.

Wondering how to get PAYDEX score for free and start improving it? Nav lets you check your Dun & Bradstreet PAYDEX rating online, for free (no credit card required). You’ll also get tips and insights to potentially impact your score, so you may negotiate better vendor terms, save money and more easily manage cash flow.

What Are the Best Lenders for Businesses With High PAYDEX Scores?

Businesses with high PAYDEX scores are more likely to qualify for small business loans that require good business credit. You’ll find a few options to consider below. To instantly compare all your best options based on your business data, sign up for Nav.

What Are the Best Lenders for Businesses With Low PAYDEX Scores?

For businesses with a low PAYDEX score, here are a few loan options to consider. As mentioned above, create a Nav account to instantly compare all your best options based on your credit score, annual revenue, and other business data.

These are designed for businesses that don’t have excellent business credit, and may request collateral in exchange for funding.

PAYDEX Scores Frequently Asked Questions

How Do I Establish Business Credit?

To establish business credit, first make sure your business is registered in your state. Next, obtain a D-U-N-S number by applying with Dun & Bradstreet. Once these steps are complete, start doing business with companies or organizations that report payment history to business credit agencies. Examples include vendors, suppliers, credit builder accounts, and business loan offers. You can also build business credit by getting business credit cards.

Now you’re ready to start building your credit profile. Meet payment terms and make payments on your open accounts on time. Make early payments if possible. Remember: Payment history is the single most important factor for building business credit. Timely payments will strengthen your score, while late payments can hurt it.

For a detailed breakdown on how to build business credit scores, read our blog. You can also create a Nav account, where we’ll provide you with all the tools you need to succeed, including free business credit score summaries and one-on-ones with credit specialists. Our Business Boost and Business Loan Builder plans also report your account payments as a tradeline, which can help build your credit score.

How Do I Get A Free Business Credit Score Report?

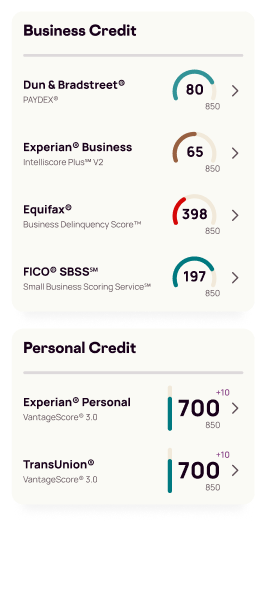

The best way to get a free business credit report summary is to sign up for Nav’s free business credit builder plan. Nav is currently the only online platform that offers this, and it includes information from the major commercial business credit bureaus, which includes Dun & Bradstreet, Experian, and Equifax. The free plan also comes with personal credit score summaries, 24/7 business and personal credit alerts, cash flow alerts and insights, and one-on-ones with credit and lending specialists.

For a full credit score report, you’ll need to upgrade to a paid plan.

Do I Need A PAYDEX Score For My Business In Order to Get A Loan?

The PAYDEX Score is generated by Dun & Bradstreet, a major commercial credit bureaus. Most lenders check your business credit score during the business loan application process, so if you want to get a loan, you should have a PAYDEX score.

This article was originally written on October 17, 2019 and updated on May 30, 2023.

Rate This Article

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

I just received my D&B number and my Paydex is showing poor. Could that be because I have no tradelines?

Yes that could be the case. You may want to check out this resource: 3 Vendors That Will Help You Build Business Credit

I pay my Bill’s on time or ahead of time every month!!! I want to know who I can contact to dispute this!!

Pam – for disputes to your Dun & Bradstreet credit report you’ll want to contact D&B directly. They offer an online service called iupdate for disputes.

How do I find more net 30 companies and some net 60 and net 90 companies

It’s harder than you think to identify those because business credit reports don’t list the names of companies that report. A lot of information we’ve seen has been outdated. We will continue to look for additional companies to add to this list.

I have 6 commercial loans on my business since 2018. I have been making timely monthly payments on them but they do not appear on any of the business credit reports. What should I do to include them on the report?

Reporting is voluntary, so if they don’t report you’ll need to get ones that do. It’s also possible they report to other bureaus. Have you checked your other credit reports – Equifax and Experian – through Nav?

They give me a c well lmao been in business over 30 years never been late that I can remember this is a joke !!!!! Do not recommend … have not advertised for work in yrs and they give me a c ??? Information they say about u not true always pay 3,4,5,6 time times the amount due

Howard Seabrook SAME HERE! I have been in business over 12 years, pay all invoices when due or before, all my business is word of mouth and like you have not advertised in years, to the point that I was going to close down all my web and social media sites. I log on to look at my business credit and it a C. Something is really fishy here. How can I tell who and who isnt reporting on my business credit. I can see who is reporting on my personal credit, why can’t I see the same thing on my business credit?

Your question about who is reporting is a valid one. It’s been a tradition for business credit reports not to list the names of companies that report and instead to categorize them only by type of account/industry. The explanation I’ve heard is that because anyone can purchase a business credit report, they are reluctant to make that information available because creditors may use it to try to steal their customers.

You’re right that business and personal credit are very different. One of the main things to understand is there are no regulations covering business credit reporting and each bureau has different practices and policies.

Keep in mind a score range that falls into “C” can be the result of few companies reporting rather than negative information. Credit reporting is voluntary and not all companies report, or not all report to all major commercial credit reporting agencies.

I enrolled the business in the credit builder plus plan. Love it and I have learned a lot. In the last two weeks we got 2 new net 30 tradelines and a business cc that reports to all business bureaus. Paid the new net 30s day after receiving the invoices. First business cc statement closed 5% utilization. We had 2 small tradelines already reported on dun & brad with ppt. When the new credit is reported, will the paydex score be weak because they are new?

Thanks,

ACE

It will take some time to build a strong score but overall it seems to happen more quickly than with consumer credit scores – especially when proactive as you are!

i pay my bills early so why is my grade a c it is never late please recheck with the company and fix my grade please

Lynette,

We translate the score the bureaus provided into a letter grade in our free account. We also update monthly. If your score isn’t strong but you’re paying your bills on time it may be that you don’t have enough accounts reporting. Feel free to reach out to our customer support team if you have more questions.

I pay my bills on time. This company is a scam. They purposely give you a low score to encourage you to sign up and pay outrages fees. Shame on them.

Bradley,

One of the things we’ve noticed at Nav is that many business owners have low scores because they have few accounts reporting. It’s not uncommon for business lenders and vendors not to report to all bureaus (or sometimes not at all.) You may want to check out this article for some suggestions: Easy Approval Net-30 Accounts And of course you can monitor your D&B data at no cost with a free Nav account.

I’ve been paying my accounts early and in advance but Paydex is still 76.

That’s not a bad score by any means James. How many accounts do you have reporting?

My paydex score is wrong. I pay my bill on time or early! Not sure where your getting your information. Please make sure you have the correct info before posting and giving a 47 year old company a bad score because they don’t want to use your premium service!

What numerical score is assigned to Nav’s ‘A’ Paydex rating?

The score range for “A” is 80 – 100.

Valuable information when needed nav thanks for your input.

Were it states that Equisure pays late and not according to terms is incorrect and needs to be changed, we have never been late to pay and most of the time early.

Scott,

I’m not sure what report you are looking at. Did you see this in your Nav account? If so feel free to reach out to our customer support team. Their contact info is in your Nav account. If you don’t have a Nav account you will need to reach out directly to Dun & Bradstreet to dispute it.

This information came in extremely handy and was very much appreciated thank you

Thanks for letting us know. We’re glad it helped!

I pay my bills within terms.

Why is it that my paydex is poor upon opening the credit, is this essentially a form on no credit?

I’m not sure I fully understand your question John, but if I do you’re asking whether the fact that you don’t have a credit history with D&B could result in a low score. Is that correct? If so the answer is yes. Barring any negative information on your credit reports, your next step is likely to build positive business credit references that report.

good day, i am new to building credit, anyway i have a few accounts am working with. my main concern is how to understand my credit report. I saw on (A) on my DUNS ACCOUNT not sure if thats good are bad, also how to know how much is your paydex score.

How do you view accounts to find out what is getting reported late?

Same question here. How do you know what vendors are reporting?

John and Linda –

Business credit reports don’t list the name of the creditor so you have to be a little bit of a detective and try to match other factors – such as a recent credit limit – to the information in your report. If you have a Nav account and continue to have trouble understanding it, feel free to reach out to our customer support team and they will do their best to help you understand it.

Also note that when you first start establishing business credit, it can take 30 – 60 days (or more) for accounts to start reporting.

If you’re looking for information on which companies will help you build business credit, you’ll find that in the BusinessLauncher section of your Nav account.

In addition, the following articles may be helpful:

Which small Business Credit Cards Report to Business Credit

3 Vendors That Will Help You Build Business Credit

Makes no sense. I ordered from Quill. Rec’s notice order was rec’d. Sent cc payment 4 days later, and D&B marked as paid day of purchase. I called Quill and they told me to wait at least 14days before paying.

Quill reports all payments 1st business day monthly unless holiday.

D & B agent told me ” their ( D & B ) mistakes can not be corrected until new info from vender. Then she pushed VERY hard to get me to sign up for $8,000.00 Credit Congierge Program I told them no.

No wonder companies have so hard a time getting anywhere.

Thanks for sharing your experience. To clarify – were you reported late?

Thanks for contacting me…My business is a startup…does PAYDEX work

with Startup businesses?

You can start to build business credit as a start up. The sooner you start building business credit, the better.

I’m not late on any of my bills

This is crazy my score with Dunn & Bradstreet is a F. I have been in business for 45 years nd never late on a payment. Hmmmmm just saying

Are you sure the information in your report is correct Joe?

The address for my dun and Bradstreet information is incorrect,

Not cremation business in Whittier ,California

Brian,

If you have a Nav account you can go into your account and reach out to customer service. They will help you understand how to dispute. If you don’t, you’ll have to contact D&B directly.

This is an educational article and we can’t correct your D&B report for you, unfortunately.

I am having a hard time getting D&B to show me how to report my business clients paid off loans. Do you have any tips on what particular department or phone number on who will help me.

It seems every time I get on the phone there I get a sales person pushing Credit Builder and I never get a call back on the info I’m askig for.

Did you see the article that we published on that topic? How to Report to Business Credit Bureaus Let me know if that helps at all.

Thank You for the insight to the Paydex Score and Scoring strategies.

A viable follow up article would be to post National Stores that automatically report trade lines i.e. Retail Chains, Financial Insitutions.to assist startups in maximizing efficiency and opportunities.

Daren –

We provide information on how to build business credit, including companies that report, in our free BusinessLauncher tool. It is included with all Nav accounts, including our free accounts.

In addition, the following articles may be helpful:

3 Vendors That Will Help You Build Business Credit

Which small Business Credit Cards Report to Business Credit

Would a CFPB & OCC Complaint against Wells Fargo for a mislaid commercial acct with accompanying safe deposit box cause a dormant Paydex Score?

I can’t imagine it would be reported.

My paydex is bogus, D&B knows it.

Dunn and Bradstreet does not report accurately. My business has paid back over $1mm in debt, and pays creditors early as part of tax planning. Yet they report my business pays one day late. Unless you pay them money they jack around with their “credit score”. Which means those with A credit paid for the rating. How accurate can that be?

I agree it’s ridiculous to be penalized for paying your bills on time. But we understand it’s the system ratings they use.

umm, you’re not penalized for paying your bills on time. You’re given more credit for paying before the agreed time.

If you negotiate terms and you fulfill the terms then why are you penalized for doing that? To only receive an 80 for doing what you agreed on is a ridiculous way to score this thing.

It certainly is different than what we are used to with personal credit.