Anticipate what you’ll need next. And know how to get it.

We’re not a lender. We help you find your best financing options.

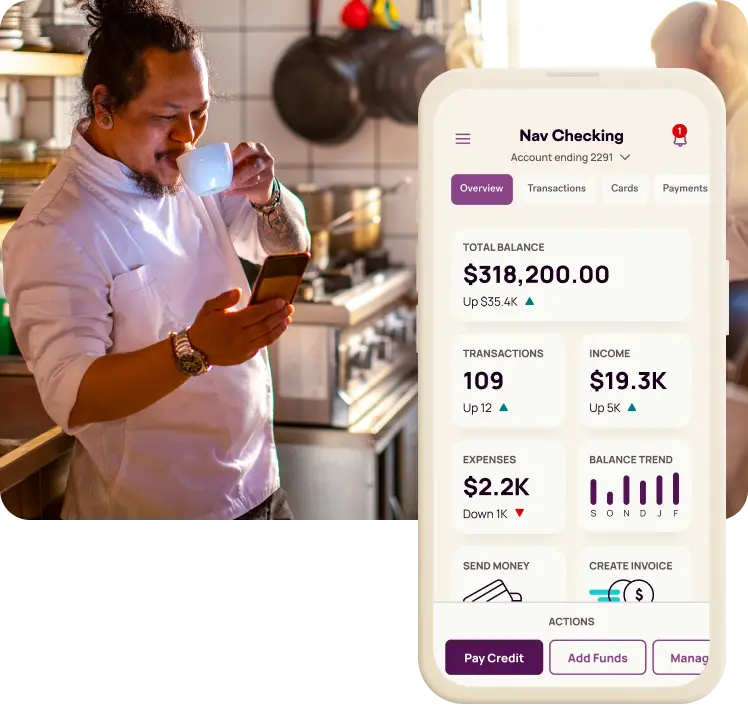

Instant access to metrics that matter most for your business

Safely share your business data, like bank transactions and credit history, for a complete picture of your small business. The more details you share with Nav, the better your recommendations.

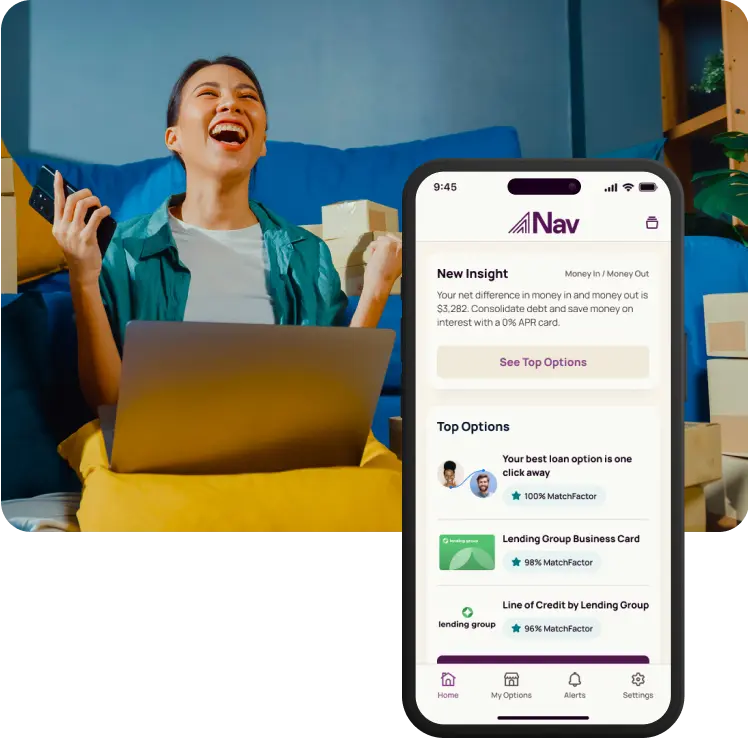

Curated options, smarter decisions

Get a customized shortlist of your best options when Nav’s technology compares your business information to our network of 200+ partners’ requirements and terms.

Know what you can qualify for before you apply

Reduce the pain in financing with streamlined applications, instant offers and approval rates that are 3.5X higher than industry averages. Let’s make it happen.

Data security

Nav keeps your data secure so you can use our solutions confidently.