What is a corporation?

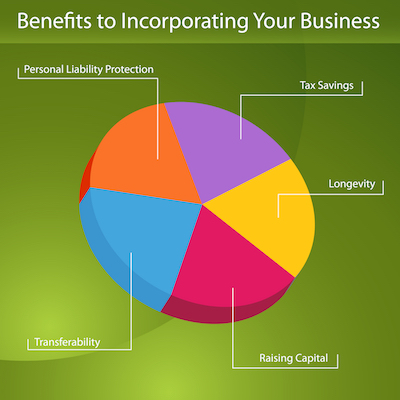

The root of the word corporation is the Latin word corpus, or body. In the eyes of the law, a corporation is a person. This person stands independent from the people who formed it and make it run. It can sue someone, buy a car, sell a product, set up contracts, and pay taxes. For business owners, the main advantage of this arrangement is that the corporation itself is liable for all of its actions, rather than the responsibility falling on the individuals who created it. Additionally, corporations enjoy unlimited life — the existence of the company doesn’t depend on the presence of any one person or group of people.

Common corporate structures

The most common corporate structures are the C Corporation, S Corporation, and LLC, or Limited Liability Company. Each comes with advantages and disadvantages, but each has the central advantage of ensuring that no one in the corporation is personally responsible for corporate debts and obligations. If someone sues your company, everyone’s personal assets are protected.

The most common corporate structures are the C Corporation, S Corporation, and LLC, or Limited Liability Company. Each comes with advantages and disadvantages, but each has the central advantage of ensuring that no one in the corporation is personally responsible for corporate debts and obligations. If someone sues your company, everyone’s personal assets are protected.

Let’s take a closer look at each of these corporate structures individually.

C Corporation

A C corporation is the corporate structure most commonly preferred by business owners seeking investors. Investors contribute money and goods to a company in exchange for a share of the company’s stock. The legal structure of a C corporation consists of a board of directors, officers, and shareholders who are required to hold annual meetings and record minutes. In addition, the rules for a C corporation are consistent from state to state. This combination of predictability and close accountability is attractive to those seeking to minimize risk when investing capital.

Other advantages of C corporations include:

- Enhanced credibility with lenders and suppliers

- Unlimited growth potential through sale of stock

- No limit on the number of shareholders

- Tax advantages such as tax-deductible business expenses

Probably the largest disadvantage of a C corporation is that its profits are taxed twice. This is called double taxation — the profits of the corporation are taxed once when earned by the corporation itself, and again when distributed as shareholders’ dividends.

S Corporation

The main purpose of an S corporation is to enable a small business or family business to enjoy the protections of a C corporation without having to pay the corporate taxes required of a larger company. Thanks to what is known as pass-through taxation, the owners of S corporations report their share of profit and loss on their individual tax returns, rather than being taxed as a corporation. This usually means a lower tax rate on company profits.

S corporations also benefit from:

- No double taxation on income — the company’s shareholders pay taxes according to their share of the company

- Paying taxes only once a year (verses quarterly, as with a C corporation)

The single biggest drawback of an S corporation is that, due to it’s considerable tax advantages, it’s limited as to its number of shareholders — 75 shareholders maximum. A growing S corporation, however, can always change its tax status to a C corporation when the time comes.

Limited Liability Company (LLC)

An LLC is one of the most popular entity structures for small businesses. It combines the asset protection of a large corporation with the streamlined simplicity of a partnership. There’s no limit on the number of members an LLC can have — any number of people can purchase equity in the company, and they don’t have to be U.S. citizens or permanent residents to do so. Finally, as with an S corporation, there’s no double taxation on income; and pass-through taxation means less paperwork and more profits.

How to incorporate a business

Incorporating is a relatively simple process. To put the wheels in motion, you should get in touch with the state office in charge of registering corporations in your state. From there, you’ll receive instructions about the necessary forms and fees — which are pretty low cost.

If you have the money and would like to save time and headache, hiring an attorney or going through a third party incorporation service like Inc for Free or LegalZoom will speed up the process.

You’ve incorporated your business — now what?

Your main job after incorporating — aside, of course, from keeping up with the strenuous demands of running a business — is simply to follow the rules of your corporation. These will vary from state to state, and some rules may change from time to time; the main thing is to stay on top of it. If you don’t, all your hard work will go to waste, as your corporation’s legal protections depend on you keeping your end of the deal. Maintaining accurate records, conducting yearly reviews of your corporate status, and getting professional advice when needed will keep you on a firm footing as you move forward.

This article was originally written on December 2, 2015 and updated on July 1, 2019.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers.

Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.